Gregory Zuckerman’s new book, The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution, is a terrific book.

When Zuckerman set out to write a book about Jim Simons’s Renaissance Technologies, Simons and others made it clear to Zuckerman not to expect any help from them. Zuckerman wasn’t surprised. He knew that Simons and team were among the most secretive traders in Wall Street history. Zuckerman writes:

There were compelling reasons I was determined to tell Simons’s story. A former math professor, Simons is arguably the most successful trader in the history of modern finance. Since 1988, Renaissance’s flagship Medallion hedge fund has generated average annual returns of 66 percent… No one in the investment world comes close. Warren Buffett, George Soros, Peter Lynch, Steve Cohen, and Ray Dalio all far short…

Zuckerman adds:

Simons’s pioneering methods have been embraced in almost every industry, and reach nearly every corner of everyday life. He and his team were crunching statistics, turning tasks over to machines, and relying on algorithms more than three decades ago–long before these tactics were embraced in Silicon Valley, the halls of government, sports stadiums, doctors’ offices, military command centers, and pretty much everywhere else forecasting is required.

With persistence, Zuckerman ended up doing over four hundred interviews with more than thirty current and former Renaissance employees. And he did interviews with a larger number of friends, family members, and others. Zuckerman:

I owe deep gratitude to each individual who spent time sharing memories, observations, and insights. Some accepted substantial personal risk to help me tell this story. I hope I rewarded their faith.

(Jim Simons, by Gert-Martin Greuel, via Wikimedia Commons)

Part One: Money Isn’t Everything

CHAPTER ONE

In the winter of 1952, Jimmy Simons was fourteen years old. He was trying to earn spending money at Breck’s garden supply near Newton, Massachusetts, where his home was. Jimmy was absent-minded and misplaced almost everything. So the owners asked him to sweep the floor. A few weeks later, having finished the Christmas-time job, the owners asked Jimmy what he wanted to do. He replied:

I want to study mathematics at MIT.

Breck’s owners burst out laughing. How could someone so absent-minded study mathematics? And at MIT? Zuckerman writes:

The skepticism didn’t bother Jimmy, not even the giggles. The teenager was filled with preternatural confidence and an unusual determination to accomplish something special, the result of supportive parents who had experienced both high hopes and deep regrets in their own lives.

Jimmy remained an only child of Marcia and Matthew Simons after Marcia endured a series of miscarriages.

A sharp intellect with an outgoing personality and subtle wit, Marcia volunteered in Jimmy’s school but never had the opportunity to work outside the home. She funneled her dreams and passions into Jimmy, pushing him academically and assuring him that success was ahead.

Matty Simons was a sales manager for 20th Century Fox. He loved the job. But then his father-in-law, Peter Kantor, asked him to work at his shoe factory. Peter promised Matty an ownership stake. Matty felt obliged to join the family business. Zuckerman:

Matty Simons spent years as the general manager of the shoe factory, but he never received the ownership share Peter had promised. Later in life, Matty told his son he wished he hadn’t forgone a promising and exciting career to do what was expected of him.

Simons says the lesson he learned was to do what you like in life, not what you think you ‘should’ do. Simons never forgot this lesson.

Even as a young kid, Simons loved to think, often about mathematics. Zuckerman:

Unlike his parents, Jimmy was determined to focus on his own passions. When he was eight, Dr. Kaplan, the Simons family doctor, suggested a career in medicine, saying it was the ideal profession “for a bright Jewish boy.”

Jimmy bristled.

“I want to be a mathematician or a scientist,” he replied.

The doctor tried to reason with the boy. “Listen, you can’t make any money in mathematics.”

Jimmy said he wanted to try.

Zuckerman continues:

He loved books, frequently visiting a local library to take out four a week, many well above his grade level. Mathematical concepts captivated him most, however.

After finishing high school in three years, the seventeen-year-old took a trip across the country with a friend. One thing they encountered was severe poverty, which made them more sensitive to the predicaments of society’s disadvantaged.

Soon Simons enrolled at MIT.

(MIT logo, via Wikimedia Commmons)

He skipped the first year of mathematics because he had taken advanced-placement courses in high school. Zuckerman:

Overconfident during the second semester of his freshman year, Simons registered for a graduate course in abstract algebra. It was an outright disaster. Simons was unable to keep up with the classmates and couldn’t understand the point of the assignments and course topics.

Simons bought a book on the subject and took it home for the summer, reading and thinking for hours at a time. Finally, it clicked. Simons aced subsequent algrebra classes. Though he received a D in an upper-level calculus course in his sophomore year, the professor allowed him to enroll in the next level’s class, which discussed Stokes’ theorem, a generalization of Isaac Newton’s fundamental theorem of calculus that relates line integrals to surface integrals in three dimensions. The young man was fascinated–a theorem involving calculus, algebra, and geometry seemed to produce simple, unexpected harmony. Simons did so well in the class that students came to him seeking help.

“I just blossomed,” Simons says. “It was a glorious feeling.”

Simons loved the beauty of mathematics. Although Simons realized he wasn’t quite the best, he had an imaginative approach to problems and an instinct to focus on the kinds of problems that might lead to breakthroughs.

When Simons returned to MIT to begin his graduate studies, his advisor suggested he finish his PhD at the University of California, Berkeley, so he could work with a professor named Shiing-Shen Chern, a former math prodigy from China and a leading differential geometer and topologist.

Meanwhile, he had met an eighteen-year-old named Barbara Bluestein. They talked a great deal and eventually decided to get engaged. Over strong objections from her parents, Barbara decided to go with Simons to Berkeley. The pair got married in Reno, Nevada. Simons used the money they had left after the marriage to play poker. He won enough to buy Barbara a black bathing suit.

Back at Berkeley:

…Simons made progress on a PhD dissertation focused on differential geometry–the study of curved, multidimensional spaces using methods from calculus, topology, and linear algebra. Simons also spent time on a new passion: trading. The couple had received $5,000 as a wedding gift, and Simons was eager to multiply the cash.

Simons bought a couple of stocks. But they didn’t move and he asked a broker if they had anything “more exciting.” The broker suggested soybeans.

Simons knew nothing about commodities or how to trade futures… but he became an eager student. At the time, soybeans sold for $2.50 per bushel. When the broker said Merrill Lynch’s analysts expected prices to go to three dollars or even higher, Simons’s eyes widened. He bought two futures contracts, watched soybeans soar, and scored several thousand dollars of profits in a matter of days.

Simons was hooked.

“I was fascinated by the action and the possibility I could make money short-term,” he says.

After a respected journal published Simons’s dissertation, he won a prestigious, three-year teaching position at MIT. However, Simons began to worry that his whole life would be research and teaching.

“Is this it? Am I going to do this my whole life?” he asked Barbara one day at home. “There has to be more.”

In 1963, Simons accepted a research position at Harvard.

CHAPTER TWO

Zuckerman writes:

In 1964, Simons quit Harvard University to join an intelligence group helping to fight the ongoing Cold War with the Soviet Union. The group told Simons he could continue his mathematics research as he worked on government assignments. Just as important, he doubled his previous salary and began paying off his debts.

Simons’s offer came from the Princeton, New Jersey, division of the Institute for Defense Analyses, an elite research organization that hired mathematicians from top universities to assist the National Security Agency–the United States’ largest and most secretive intelligence agency–in detecting and attacking Russian codes and ciphers.

…The IDA taught Simons how to develop mathematical models to discern and interpret patterns in seemingly meaningless data. He began using statistical analysis and probability theory, mathematical tools that would influence his work.

Simons learned that he liked making algorithms and testing things out on a computer. Simons became a sleuthing star.

Also, Simons learned by seeing how the group recruited new researchers. The recruits were identified by brainpower, creativity, and ambition, rather than for any particular expertise or background. Simons met Lenny Baum, one of the most-accomplished code breakers. Baum developed a saying that became the group’s credo:

“Bad ideas is good, good ideas is terrific, no ideas is terrible.”

Zuckerman notes:

The team routinely shared credit and met for champagne toasts after discovering solutions to particularly thorny problems. Most days, researchers wandered into one another’s offices to offer assistance or lend an ear. When staffers met each day for afternoon tea, they discussed the news, played chess, worked on puzzles, or competed at Go, the complicated Chinese board game.

Simons and his wife threw regular dinner parties at which IDA staffers became inebriated on Barbara’s rum-heavy Fish House Punch. The group played high-stakes poker matches that lasted until the next morning, with Simons often walking away with fistfuls of his colleagues’ cash.

Meanwhile, Simons was making progress in his research on minimal varieties, a subfield of differential geometry in which he long had an interest. Zuckerman:

He was hoping to discover and codify universal principles, rules, and truths, with the goal of furthering the understanding of these mathematical objects. Albert Einstein argued that there is a natural order in the world; mathematicians like Simons can be seen as searching for evidence of that structure. There is true beauty to their work, especially when it succeeds in revealing something about the universe’s natural order. Often, such theories find practical applications, even many years later, while advancing our knowledge of the universe.

Eventually, a series of conversations with Frederick Almgren Jr., a professor at nearby Princeton University who had solved the problem in three dimensions, helped Simons achieve a breakthrough. Simons created a partial differential equation of his own, which became known as the Simons equation, and used it to develop a uniform solution through six dimensions…

In 1968, Simons published “Minimal Varieties in Riemannian Manifolds,” which became a foundational paper for geometers, proved crucial in related fields, and continues to garner citations, underscoring its enduring significance. These achievements helped establish Simons as one of the world’s preeminent geometers.

At the same time, Simons was studying the stock market in an effort to figure out how to make money. Collaborating with Baum and two other colleagues, Simons developed a stock-trading system. Simons and his colleagues ignored fundamental information such as earnings, dividends, and corporate news. Instead, they searched for “macroscopic variables” that could predict the short-term behavior of the stock market.

Here’s what was really unique: [They] didn’t try to identify or predict these states using economic theory or other conventional methods, nor did the researchers seek to address why the market entered certain states. Simons and his colleagues used mathematics to determine the set of states best fitting the observed pricing data; their model then made its bets accordingly. The whys didn’t matter, Simons and his colleagues seemed to suggest, just the strategies to take advantage of the inferred states.

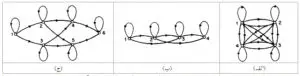

Simons and his colleagues used a mathematical tool called a hidden Markov model.

(Hidden Markov models, via Wikimedia Commons)

Also, they weren’t alone. For instance, mathematician Ed Thorp developed an early form of computerized trading.

***

Simons was really good at identifying the most promising ideas of his colleagues. Soon, he was in line to become deputy director of IDA. Then came the Vietnam war. Simons wrote a six-paragraph letter to The New York Times, arguing that there were better uses of the nation’s resources than the Vietnam war. As a result, IDA fired Simons.

A friend asked Simons what his ideal job was. Simons said he’d like to be the chair of a large math department, but he was too young and didn’t know the right people. The friend told Simons that he had an idea. Soon thereafter, Simons received a letter from John Toll, president of SUNY Stony Brook, a public university on Long Island. The school had already spent five years looking for someone to chair its math department.

Toll was leading a $100 million, government-funded push to make SUNY Stony Brook the “Berkeley of the East.”

In 1968, Simons moved his family to Long Island and he began recruiting. One person he targeted was a Cornell University mathematician named James Ax, who had won the prestigious Cole Prize in number theory. Simons and Ax had been friendly as graduate students at Berkeley. Simons charmed Ax into moving to Stony Brook. Zuckerman:

Ax’s decision sent a message that Simons meant business. As he raided other schools, Simons refined his pitch, focusing on what it might take to lure specific mathematicians. Those who valued money got raises; those focused on personal research got lighter class loads, extra leave, generous research support, and help evading irritating administrative requirements.

Meanwhile, Simons’s marriage to Barbara was struggling. They eventually divorced. Barbara went on to earn a PhD in computer science at Berkeley in 1981. Subsequently, she had a distinguished career. Asked about her marriage to Simons, she reflected that they had gotten married when they were too young.

Now alone on Long Island, Simons sought a nanny to help when his three children were at his house. That’s how he met Marilyn Hawrys, a twenty-two-year-old blond who later became a graduate student in economics at Stony Brook. Simons asked her on a date, and they started seeing each other.

Around this time, Simons made a breakthrough with Shiing-Shen Chern.

On his own, Simons made a discovery related to quantifying shapes in curved, three-dimensional spaces. He showed his work to Chern, who realized the insight could be extended to all dimensions. In 1974, Chern and Simons published “Characteristic Forms and Geometric Invariants,” a paper that introduced Chern-Simons invariants… which proved useful in various aspects of mathematics.

In 1976, at the age of thirty-seven, Simons was awarded the American Mathematical Society’s Oswald Veblen Prize in Geometry, the highest honor in the field, for his work with Chern and his earlier research in minimal varieties. A decade later, theoretical physicist Edward Witten and others would discover that Chern-Simons theory had applications to a range of areas in physics, including condensed matter, string theory, and supergravity. It even became crucial to methods used by Microsoft and others in their attempts to develop quantum computers capable of solving problems vexing modern computers, such as drug development and artificial intelligence. By 2019, tens of thousands of citations in academic papers–approximately three a day–referenced Chern-Simons theory, cementing Simons’s position in the upper echelon of mathematics and physics.

Simons was ready for a new challenge. He had recently invested money with Charlie Freifeld, who had taken a course from Simons at Harvard. Freifeld used econometric models to predict the prices of commodities. Soon Simons’s investment with Freifeld had increased tenfold. This got Simons’s excited again about the challenge of investing.

In 1978, Simons left academia to start an investment firm focused on currency trading. (World currencies had recently been allowed to float.) Some academics thought that Simons was squandering a rare talent.

CHAPTER THREE

Early summer of 1978, a few miles down the road from Stony Brook University:

Simons sat in a storefront office in the back of a dreary strip mall. He was next to a woman’s clothing boutique, two doors down from a pizza joint, and across from the tiny, one-story Stony Brook train station. His space, built for a retail establishment, had beige wallpaper, a single computer terminal, and spotty phone service. From his window, Simons could barely see the aptly named Sheep Pasture Road, an indication of how quickly he had gone from broadly admired to entirely obscure.

The odds weren’t in favor of a forty-year-old mathematician embarking on his fourth career, hoping to revolutionize the centuries-old world of investing.

Simons hadn’t shown any real talent in investing. He acknowledged that his investment with Freifeld had been “completely lucky.”

They only held on to the profits because they had agreed to cash out if they ever made a large amount. Weeks after they sold their position, sugar prices plummeted, which neither Freifeld nor Simons had predicted. They had barely avoided disaster. Zuckerman:

Somehow, Simons was bursting with self-confidence. He had conquered mathematics, figured out code-breaking, and built a world-class university department. Now he was sure he could master financial speculation, partly because he had developed a special insight into how financial markets operated.

[…]

It looks like there’s some structure here, Simons thought.

He just had to find it.

Simons decided to treat financial markets like any other chaotic system. Just as physicists pore over vast quantities of data and build elegant models to identify laws in nature, Simons would built mathematical models to identify order in financial markets. His approach bore similarities to the strategy he had developed years earlier at the Institute for Defense Analyses, when he and his colleagues wrote the research paper that determined that markets existed in various hidden states that could be identified with mathematical models. Now Simons would test the approach in real life.

Simons named his company Monemetrics, combining “money” and “econometrics.” He then began a process he knew well: hiring a team of big brains. Zuckerman:

He did have an ideal partner in mind for his fledgling firm: Leonard Baum, one of the coauthors of the IDA research paper and a mathematician who had spent time discerning hidden states and making short-term predictions in chaotic environments. Simons just had to convince Baum to risk his career on Simons’s radical, unproven approach.

Baum’s parents had fled Russia for Brooklyn to escape poverty and anti-Semitism. In high school, Baum was six feet tall and his school’s top sprinter. He also played tennis. Baum graduated Harvard University in 1953 and then earned a PhD in mathematics. Zuckerman:

After joining the IDA in Princeton, Baum was even more successful breaking code than Simons, receiving credit for some of the unit’s most important, and still classified, achievements.

[…]

Balding and bearded, Baum pursued math research while juggling government assignments, just like Simons. Over the course of several summers in the late 1960s, Baum and Lloyd Welch, an information theorist working down the hall, developed an algorithm to analyze Markov chains, which are sequences of events in which the probability of what happens next depends only on the current state, not past events. In a Markov chain, it is impossible to predict future steps with certainty, yet one can observe the chain to make educated guesses about possible outcomes…

A hidden Markov process is one in which the chain of events is governed by unknown, underlying parameters or variables. One sees the results of the chain but not the “states” that help explain the progression of the chain… Some investors liken financial markets, speech recognition patterns, and other complex chains of events to hidden Markov models.

The Baum-Welch algorithm provided a way to estimate probabilities and parameters within these complex sequences with little more information than the output of the processes…

Baum usually minimized the importance of his accomplishment. Today, though, Baum’s algorithm, which allows a computer to teach itself states and probabilities, is seen as one of the twentieth century’s notable advances in machine learning, paving the way for breakthroughs affecting the lives of millions in fields from genomics to weather prediction. Baum-Welch enabled the first effective speech recognition system and even Google’s search engine.

Zuckerman again:

Baum began working with Simons once a week. By 1979, Baum, then forty-eight years old, was immersed in trading, just as Simons had hoped. A top chess player in college, Baum felt he had discovered a new game to test his mental faculties. He received a one-year leave of absence from the IDA and moved his family to Long Island and a rented, three-bedroom Victorian house lined with tall bookcases…

It didn’t take Baum long to develop an algorithm directing Monemetrics to buy currencies if they moved a certain level below their recent trend line and sell if they veered too far above it. It was a simple piece of work, but Baum seemed on the right path, instilling confidence in Simons.

Zuckerman adds:

Baum became so certain their approach would work, and so hooked on investing, that he quit the IDA to work full-time with Simons.

Baum would receive 25 percent of the company’s profits. Simons would test strategies in Monemetrics. If they worked, he would implement them in a limited investment partnership he launched called Limroy, which included money from outside investors. Simons had tried to raise $4 million and had gotten close enough that he felt ready to launch. Zuckerman:

To make sure he and Baum were on the right track, Simons asked James Ax, his prized recruit at Stony Brook, to come by and check out their strategies. Like Baum a year or so earlier, Ax knew little about investing and cared even less. He immediately understood what his former colleagues were trying to accomplish, though, and became convinced they were onto something special. Not only could Baum’s algorithm succeed in currencies, Ax argued, but similar predictive models could be developed to trade commodities, such as wheat, soybeans, and crude oil. Hearing that, Simons persuaded Ax to leave academia, setting him up with his own trading account. Now Simons was really excited. He had two of the most acclaimed mathematicians working with him to unlock the secrets of the markets and enough cash to support their efforts.

One day Baum realized that Margaret Thatcher was keeping the British pound at an unsustainably low level.

Overcome with excitement, he rushed to the office to tell Simons. They started buying as much as they could of the British pound, which shot up in value. They then made accurate predictions for the Japanese Yen, West German deutsche mark, and Swiss franc. The fund made tens of millions of dollars. Zuckerman:

After racking up early currency winnings, Simons amended Limroy’s charter to allow it to trade US Treasury bond futures contracts as well as commodities. He and Baum–who now had their own, separate investment accounts–assembled a small team to build sophisticated models that might identify profitable trades in currency, commodity, and bond markets.

Simons was having a great time, but the fun wouldn’t last.

***

Simons needed someone to program their computers. He discovered Greg Hullender, a nineteen-year-old student at the California Institute of Technology. Simons offered Hullender $9,000 a year plus a share of the firm’s profits.

Limroy proceeded to lose money for the next six months. Simons was despondent. At one point he told Hullender, “Sometimes I look at this and feel I’m just some guy who doesn’t really know what he’s doing.” Zuckerman:

In the following days, Simons emerged from his funk, more determined than ever to build a high-tech trading system guided by algorithms, or step-by-step computer instructions rather than human judgment.

[…]

The technology for a fully automated system wasn’t there yet, Simons realized, but he wanted to try some more sophisticated methods.

Simons proceeded to launch a project of gathering as much past data as possible. He got commodity, bond, and currency prices going back decades, even before World War II in some cases. Zuckerman:

Eventually, the group developed a system that could dictate trades for various commodity, bond, and currency markets.

The system produced automated trade recommendations, a step short of automated trades, but the best they could do then. But soon Simons and Baum lost confidence in their system. They couldn’t understand why the system was making certain recommendations, and also they had another losing streak.

Simons and Baum drifted towards a more traditional investing approach. They looked for undervalued investments and also tried to get the news faster than others in order to react to it before others. They were investing about $30 million at that point. Zuckerman writes:

Their traditional trading approach was going so well that, when the boutique next door closed, Simons rented the space and punched through the adjoining wall. The new space was filled with offices for new hires, including an economist and others who provided expert intelligence and made their own trades, helping to boost returns. At the same time, Simons was developing a new passion: backing promising technology companies, including an electronic dictionary company called Franklin Electronic Publishers, which developed the first hand-held computer.

In 1982, Simons changed Monemetrics’ name to Renaissance Technologies Corporation, reflecting his developing interest in these upstart companies. Simons came to see himself as a venture capitalist as much as a trader.

Meanwhile, Baum excelled by relying on his own research and intuition:

He was making so much money trading various currencies using intuition and instinct that pursuing a systematic, “quantitative” style of trading seemed a waste of time. Building formulas was difficult and time-consuming, and the gains figured to be steady but never spectacular. By contrast, quickly digesting the office’s news ticker, studying newspaper articles, and analyzing geopolitical events seemed exciting and far more profitable.

Between July 1979 and March 1982, Baum made $43 million in profits, almost double his original stake from Simons.

Baum tended to hold on to his investments when he thought that a given trend would continue. Eventually this caused a rift between Baum and Simons. For example, in the fall of 1979, both Baum and Simons bought gold around $250 an ounce.

(Photo by Daniel Schreurs)

By January 1980, gold had soared past $700. Simons sold his position, but Baum held on thinking the trend would continue. Around this time, Simons learned that people were lining up to sell their physical gold–like jewelry–to take advantage of the high prices. Simons grew concerned that the increase in supply could crush gold prices.

When he got back in the office, Simons ordered Baum to sell. Baum refused. Baum was sitting on more than $10 million in profits and gold had shot past $800 an ounce. Baum was driving Simons crazy. Finally Simons called the firm’s broker and put the phone to Baum’s ear. Simons ordered Baum: “Tell him you’re selling.” Baum finally capitulated. Within months, gold shot past $865 an ounce and Baum was complaining that Simons had cost him serious money. But just a few months later, gold was under $500.

In 1983, Federal Reserve Chair Paul Volcker predicted a decline in interest rates, and inflation appeared to be under control. Baum purchased tens of millions of dollars of US bonds. However, panic selling overcame the bond market in the late spring of 1984 amid a large increase in bond issuance by the Reagan administration.

Once again, Simons told Baum to lighten up, but Baum refused. Baum also had a huge bet that the Japanese Yen would continue to appreciate. That bet was also backfiring. Zuckerman:

When the value of Baum’s investment positions had plummeted 40 percent, it triggered an automatic clause in his agreement with Simons, forcing Simons to sell all of Baum’s holdings and unwind their trading affiliation, a sad denouement to a decades-long relationship between the esteemed mathematicians.

Ultimately, Baum was very right about US bonds. By then, Baum was only trading for himself. Baum also returned to Princeton. He was now sleeping better and he had time for mathematics. Baum focused on prime numbers and the Riemann hypothesis. Also, for fun, he traveled the United States and competed in Go tournaments.

Meanwhile, Simons was upset about the losses. He considered just focusing on technology investing. He gave clients an opportunity to withdraw, but most kept faith that Simons would figure out a way to improve results.

CHAPTER FOUR

Simons came to the conclusion that Baum’s approach, using intellect and instinct, was not a reliable way to make money. Simons commented: “If you make money, you feel like a genius. If you lose, you’re a dope.” Zuckerman:

Simons wondered if the technology was yet available to trade using mathematical models and preset algorithms, to avoid the emotional ups and downs that come with betting on markets with only intelligence and intuition. Simons still had James Ax working for him, a mathematician who seemed perfectly suited to build a pioneering computer trading system. Simons resolved to back Ax with ample support and resources, hoping something special would emerge.

Zuckerman continues:

In 1961, Ax earned a PhD in mathematics from the University of California, Berkeley, where he became friends with Simons, a fellow graduate student. Ax was the first to greet Simons and his wife in the hospital after Barbara gave birth to their first child. As a mathematics professor at Cornell University, Ax helped develop a branch of pure mathematics called number theory. In the process, he forged a close bond with a senior, tenured academic named Simon Kochen, a mathematical logician. Together, the professors tried to prove a famous fifty-year-old conjecture made by the famed Austrian mathematician Emil Artin, meeting immediate and enduring frustration. To blow off steam, Ax and Kochen initiated a weekly poker game with colleagues and others in the Ithaca, New York, area. What started as friendly get-togethers, with winning pots that rarely topped fifteen dollars, grew in intensity until the men fought over stakes reaching hundreds of dollars.

[…]

Ax spent the 1970s searching for new rivals and ways to best them. In addition to poker, he took up golf and bowling, while emerging as one of the nation’s top backgammon players.

In 1979, Ax joined Simons. First Ax looked at fundamentals. Zuckerman:

Ax’s returns weren’t remarkable, so he began developing a trading system to take advantage of his math background. Ax mined the assorted data Simons and his team had collected, crafting algorithms to predict where various currencies and commodities were headed.

[…]

Ax’s predictive models had potential, but they were quite crude. The trove of data Simons and others had collected proved of little use, mostly because it was riddled with errors and faulty prices. Also, Ax’s trading system wasn’t in any way automated–his trades were made by phone, twice a day, in the morning and at the end of the trading day.

Ax soon began to rely on a former professor: Sandor Straus earned a PhD in mathematics from Berkeley in 1972 and went to teach at Stony Brook. Straus thrived. And he wore a long ponytail with John Lennon-style glasses. In 1976, Straus joined Stony Brook’s computer center. He helped Ax and others develop computer simulations. But Straus wasn’t happy and was worried about money. Simons offered to double Straus’s salary if he joined Monemetrics as a computer specialist.

Against the consistent advice of his father and friends, Straus eventually decided to join Monemetrics. Straus began collecting a wide range of data. Zuckerman:

No one had asked Straus to track down so much information. Opening and closing prices seemed sufficient to Simons and Ax. They didn’t even have a way to use all the data Straus was gathering, and with computer-processing power still limited, that didn’t seem likely to change. But Straus figured he’d continue collecting the information in case it came in handy down the road.

Straus became somewhat obsessive in his quest to locate pricing data before others realized its potential value. Straus even collected information on stock trades, just in case Simons’s team wanted it at some point in the future. For Straus, gathering data became a matter of personal pride.

Zuckerman adds:

…No one had told Straus to worry so much about the prices, but he had transformed into a data purist, foraging and cleaning data the rest of the world cared little about.

…Some other traders were gathering and cleaning data, but no one collected as much as Strauss, who was becoming something of a data guru.

Straus’s data helped Ax improve his trading results…

Simons asked Henry Laufer, another Stony Brook mathematician, to join Monemetrics. Laufer agreed. Zuckerman:

Laufer created computer simulations to test whether certain strategies should be added to their trading model. The strategies were often based on the idea that prices tend to revert after an initial move higher or lower. Laufer would buy futures contracts if they opened at unusually low prices compared with their previous closing price, and sell if prices began the day much higher than their previous close. Simons made his own improvements to the evolving system, while insisting that the team work together and share credit.

In 1985, Ax moved to Huntington Beach, California. Ax and Straus established a new company: Axcom Limited. Simons would get 25 percent of the profits, while Ax and Straus split the remaining 75 percent. Laufer didn’t want to move west, so he returned to Stony Brook. Zuckerman writes:

By 1986, Axcom was trading twenty-one different futures contracts, including the British pound, Swiss franc, deutsche mark, Eurodollars, and commodities including wheat, corn, and sugar. Mathematical formulas developed by Ax and Straus generated most of the firm’s moves, though a few decisions were based on Ax’s judgment calls. Before the beginning of trading each day, and just before the end of trading in the late afternoon, a computer program would send an electronic message to Greg Olsen, their broker at an outside firm, with an order and some simple conditions. One example: “If wheat opens above $4.25, sell 36 contracts.”

However, Simons and the team were not finding new ways to make money, nor were they improving on their existing methods, which allowed rivals to catch up. Zuckerman:

Eventually, Ax decided they needed to trade in a more sophisticated way. They hadn’t tried using more-complex math to build trading formulas, partly because the computing power didn’t seem sufficient. Now Ax thought it might be time to give it a shot.

Ax had long believed financial markets shared characteristics with Markov chains, those sequences of events in which the next event is only dependent on the current state. In a Markov chain, each step along the way is impossible to predict with certainty, but future steps can be predicted with some degree of accuracy if one relies on a capable model…

To improve their predictive models, Ax concluded it was time to bring in someone with experience developing stochastic equations, the broader family of equations to which Markov chains belong. Stochastic equations model dynamic processes that evolve over time and can involve a high level of uncertainty.

Soon Rene Carmona, a professor at University of California, Irvine, got a call from a friend who told him a group of mathematicians was looking for someone with his specialty–stochastic differential equations. Simons, Ax, and Straus were interested. Zuckerman:

Perhaps by hiring Carmona, they could develop a model that would produce a range of likely outcomes for their investments, helping to improve their performance.

Carmona was eager to lend a hand–he was consulting for a local aerospace company at the time and liked the idea of picking up extra cash working for Axcom a few days a week. The challenge of improving the firm’s trading results also intrigued him.

“The goal was to invent a mathematical model and use it as a framework to infer some consequences and conclusions,” Carmona says. “The name of the game is not to always be right, but to be right often enough.”

In 1987, after having made little progress, Carmona decided to spend the summer working full-time for Axcom. Yet Carmona still couldn’t generate useful results. Carmona soon realized that they needed regressions that could capture nonlinear relationships in market data. Zuckerman explains:

He suggested a different approach. Carmona’s idea was to have computers search for relationships in the data Strauss had amassed. Perhaps they could find instances in the remote past of similar trading environments, then they could examine how prices reacted. By identifying comparable trading situations and tracking what subsequently happened to prices, they could develop a sophisticated and accurate forecasting model capable of detecting hidden patterns.

For this approach to work, Axcom needed a lot of data, even more than Strauss and the others had collected. To solve the problem, Strauss began to model data rather than just collect it. In other words, to deal with gaps in historical data, he used computer models to make educated guesses as to what was missing. They didn’t have extensive cotton pricing data from the 1940s, for example, but maybe creating the data would suffice…

Carmona suggested letting the model run the show by digesting all the various pieces of data and spitting out buy-and-sell decisions. In a sense, he was proposing an early machine-learning system. The model would generate predictions for various commodity prices based on complex patterns, clusters, and correlations that Carmona and the others didn’t understand themselves and couldn’t detect with the naked eye.

Elsewhere, statisticians were using similar approaches–called kernel methods–to analyze patterns in data sets.

At first, Simons couldn’t get comfortable because he couldn’t understand why the model was reaching certain conclusions. Carmona told Simons to follow the data. Ax urged Simons to let the computers do it.

(Illustration by Dmitry Gorelkin)

Zuckerman:

When the Axcom team started testing the approach, they quickly began to see improved results. The firm began incorporating higher dimensional kernel regression approaches, which seemed to work best for trending models…

Simons was convinced they could do even better. Carmona’s ideas helped, but they weren’t enough. Simons called and visited, hoping to improve Axcom’s performance, but he mostly served as the pool operator, finding wealthy investors for the fund and keeping them happy, while attending to the various technology investments that made up about half of the $100 million assets now held by the firm.

Seeking even more mathematical firepower, Simons arranged for a well-respected academic to consult with the firm. That move would lay the groundwork for a historic breakthrough.

CHAPTER FIVE

Elwyn Berlekamp attended MIT. In his senior year, Berlekamp won a prestigious math competition to become a Putnam Fellow. While pursuing a PhD at MIT, he focused on electrical engineering, studying with Peter Elias and Claude Shannon. One day Shannon pulled Berlekamp aside and told him it wasn’t a good time to invest in the stock market. Berlekamp had no money, so he laughed. Also, he thought investing was a game where rich people play and that it doesn’t do much to improve the world.

During the summers of 1960 and 1962, Berlekamp worked as a research assistant at Bell Laboratories research center in Murray Hill, New Jersey. While there, he worked for John Larry Kelly, Jr. Kelly was a brilliant physicist who had been a pilot in the US Navy in World War II. Kelly smoked six packs of cigarettes a day and invented a betting system to bet on college and professional football. Kelly invented the Kelly criterion.

The Kelly criterion can be written as follows (Zuckerman doesn’t mention this, but it’s worth noting):

-

- F = p – [q/o]

where

-

- F = Kelly criterion fraction of current capital to bet

- o = Net odds, or dollars won per $1 bet if the bet wins (e.g., the bet may pay 5 to 1, meaning you win $5 per each $1 bet if the bet wins)

- p = probability of winning

- q = probability of losing = 1 – p

The Kelly criterion has a unique mathematical property: if you know the probability of winning and the net odds (payoff), then betting exactly the percentage determined by the Kelly criterion leads to the maximum long-term compounding of capital, assuming that you’re going to make a long series of bets. Betting any percentage that is not equal to that given by the Kelly criterion will inevitably lead to lower compound growth over a long period of time.

Berlekamp finished his PhD at the University of California, Berkeley. He became an assistant professor of electrical engineering. Zuckerman:

Berlekamp became an expert in decoding digital information, helping NASA decipher images coming back from satellites exploring Mars, Venus, and other parts of the solar system. Employing principles he had developed studying puzzles and games… Berlekamp cofounded a branch of mathematics called combinatorial game theory and wrote a book called Algebraic Coding Theory, a classic in the field.

By the late 1960s, the Institute for Defense Analyses (IDA) hired Berlekamp. He met Simons, but the two didn’t hit it off, despite having both spent time at MIT, Berkeley, and IDA.

“His mathematics were different from mine,” Berlekamp says. “And Jim had an insatiable urge to do finance and make money. He likes action… He was always playing poker and fussing around with the markets.”

In 1973, Berlekamp became the part owner of a cryptography company. In 1985, Eastman Kodak acquired the company, giving Berlekamp an unexpected windfall. Berlekamp complained that the money caused challenges in his marriage. His wife wanted a bigger house, while he wanted to travel.

While trying to figure out how to invest the money, a friend told him to look at commodities. This led Berlekamp to contact Simons, who told him, “I have just the opportunity for you.” Berlekamp started flying to Huntington Beach a couple of times a month to learn to trade and to see if his expertise in statistical information theory might be useful. Zuckerman says:

For all the brainpower the team was employing, and the help they were receiving from Carmona and others, Axcom’s model usually focused on two simple and commonplace trading strategies. Sometimes, it chased prices, or bought various commodities that were moving higher or lower on the assumption that the trend would continue.

Other times, the model wagered that a price move was petering out and would reverse: a reversion strategy.

Ax had access to more extensive pricing information than his rivals, thanks to Straus’s growing collection of clean, historic data. Since price movements often resembled those of the past, that data enabled the firm to more accurately determine when trends were likely to continue and when they were ebbing. Computing power had improved and become cheaper, allowing the team to produce more sophisticated trading models, including Carmona’s kernel methods–the early, machine-learning strategy that had made Simons so uncomfortable. With those advantages, Axcom averaged annual gains of about 20 percent, topping most rivals.

Yet Simons kept asking why returns weren’t better. Adding to the tension, their rivals were multiplying.

With the Kelly criterion in mind, Berlekamp told Ax that when the odds were higher, they should make bigger bets. Ax said they would, but seemed noncommittal. Zuckerman:

Berlekamp discovered other problems with Axcom’s operations. The firm traded gold, silver, copper, and other metals, as well as hogs and other meats, and grains and other commodities. But their buy-and-sell orders were still placed through emailed instructions to their broker, Greg Olsen, at the open and close of each trading day, and Axcom often held on to investments for weeks or even months at a time.

That’s a dangerous approach, Berlekamp argued, because markets can be volatile. Infrequent trading precluded the firm from jumping on new opportunities as they arose and led to losses during extended downturns. Berlekamp urged Ax to look for smaller, short-term opportunities–get in and get out. Ax brushed him off again, this time citing the cost of doing rapid trading. Besides, Straus’s intraday price data was riddled with inaccuracies–he hadn’t fully “cleaned” it yet–so they couldn’t create a reliable model for short-term trades.

Meanwhile, some investors didn’t have faith in Simons’s venture-capital investments. So Simons closed it down in March 1988 and opened, with Ax, an offshore hedge fund focused solely on trading. They named the hedge fund Medallion because each had gotten a prestigious math award.

Within six months, Medallion was struggling. Part of it seemed to be due to the fact that Ax had gotten less focused. He moved to an isolated spot near Malibu and he rarely came in to the office even though he was managing nearly a dozen employees. Soon Ax purchased a spectacular home on a cliff in Pacific Palisades.

At one point in 1989, Medallion was down nearly 30 percent from the middle of the previous year. Simons ordered Axcom to halt all trading based on the firm’s struggling, longer-term predictive signals until Ax and his team developed a plan to improve results. In the meantime, Ax was only allowed to do short-term trading, which was just 10 percent of the fund’s activity.

Ax thought Simons’s order violated their partnership agreement. Ax was going to sue Simons. Technically, however, Axcom was trading for a general partnership controlled by Simons.

Then Berlekamp offered to buy Ax’s stake. Ax agreed. The deal left Berlekamp with a 40 percent stake in the firm, while Straus and Simons had 25 percent each. Ax still had 10 percent. But he effectively retired from trading. Ax moved to San Diego. He wrote poetry, took screenwriting classes, and wrote a science-fiction thriller.

CHAPTER SIX

Berlekamp moved the firm close to his home in Berkeley.

The team forged ahead, with Berlekamp focused on implementing some of the most promising recommendations Ax had ignored. Simons, exhausted from months of bickering with Ax, supported the idea.

“Let’s bank some sure things,” Berlekamp told Simons.

In addition to the issue of cost, short-term trading interested few investors because the gains were tiny. Zuckerman:

Berlekamp hadn’t worked on Wall Street and was inherently skeptical of long-held dogmas developed by those he suspected weren’t especially sophisticated in their analysis. He advocated for more short-term trades. Too many of the firm’s long-term moves had been duds, while Medallion’s short-term trades had proved its biggest winners, thanks to the work of Ax, Carmona, and others. It made sense to try to build on that success. Berlekamp also enjoyed some good timing–by then, most of Straus’s intraday data had been cleaned up, making it easier to develop fresh ideas for shorter-term trades.

Their goal remained the same: scrutinize historic price information to discover sequences that might repeat, under the assumption that investors will exhibit similar behavior in the future.

Berlekamp also observed that doing a higher number of shorter-term trades meant that no individual trade could hurt results. This reduces the portfolio’s risk. Berlekamp and his colleagues view Medallion as being like a casino.

“If you trade a lot, you only need to be right 51 percent of the time,” Berlekamp argued to a colleague. “We need a smaller edge on each trade.”

Zuckerman writes:

Simons and his researchers didn’t believe in spending much time proposing and testing their own intuitive trade ideas. They let the data point them to the anomalies signaling opportunity. They also didn’t think it made sense to worry about why these phenomena existed. All that mattered was that they happened frequently enough to include in their updated trading system, and that they could be tested to ensure they weren’t statistical flukes.

Zuckerman again:

Beyond the repeating sequences that seemed to make sense, the system Berlekamp, Laufer, and Straus developed spotted barely perceptible patterns in various markets that had no apparent explanation. These trends and oddities sometimes happened so quickly that they were unnoticeable to most investors. They were so faint, the team took to calling them ghosts, yet they kept reappearing with enough frequency to be worth additions to their mix of trade ideas. Simons had come around to the view that the whys didn’t matter, just that the trades worked.

[…]

By late 1989, after about six months of work, Berlekamp and his colleagues were reasonably sure their rebuilt trading system–focused on commodity, currency, and bond markets–could prosper.

[…]

The firm implemented its new approach in late 1989 with the $27 million Simons still managed. The results were almost immediate, startling nearly everyone in the office. They did more trading than ever, cutting Medallion’s average holding time to just a day and a half from a week and a half, scoring profits almost every day.

At one point, Medallion had every one of its positions with the Stotler Group, a commodity-trading firm run by Karsten Mahlmann. There were rumors Stotler was in trouble. Berlekamp wasn’t sure what to do. But Simons was. He ordered Berlekamp to move all their positions to a different broker. So he did. Soon Stotler filed for bankruptcy. Zuckerman:

Simons and his firm had narrowly escaped a likely death blow.

***

Zuckerman writes:

For much of 1990, Simons’s team could do little wrong, as if they had discovered a magic formula after a decade of fumbling around in the lab. Rather than transact only at the open and close of trading each day, Berlekamp, Laufer, and Strauss traded at noon, as well. Their system became mostly short-term moves, with long-term trades representing about 10 percent of activity.

One day, Axcom made more than $1 million, a first for the firm. Simons rewarded the team with champagne, much as the IDA’s staff had passed around flutes of bubbly after discovering solutions to thorny problems.

(Photo by William MacGregor)

Zuckerman:

Medallion scored a gain of 55.9 percent in 1990, a dramatic improvement on its 4 percent loss the previous year. The profits were especially impressive because they were over and above the hefty fees charged by the fund, which amounted to 5 percent of all assets managed and 20 percent of all gains generated by the fund.

Simons was convinced that the team had discovered a highly profitable strategy. Nonetheless, he kept messing around with trade ideas like gold. Zuckerman:

Berlekamp was baffled. It was Simons who had pushed to develop a computerized trading system free of human involvement, and it was Simons who wanted to rely on the scientific method, testing overlooked anomalies rather than using crude charts or gut instinct. Berlekamp, Laufer, and the rest of the team had worked diligently to remove humans from the trading loop as much as possible. Now Simons was saying he had a good feeling about gold prices and wanted to tweak the system?

[…]

“We must still rely on human judgment and manual intervention to cope with a drastic, sudden change,” [Simons] explained in a letter [to clients] that month.

Simons told Berlekamp how much better the fund should be doing. Simons was convinced the $40 million fund could achieve remarkable success. Berlekamp didn’t think the fund could do much better than it already had. Eventually Berlekamp–who was enjoying teaching at Berkeley more than ever–suggested to Simons that Simons buy him out. Zuckerman:

Which is exactly what Simons did. In December 1990, Axcom was disbanded; Simons purchased Berlekamp’s ownership interest for cash, while Strauss and Ax traded their Axcom stakes for shares in Renaissance, which began to manage the Medallion fund. Berlekamp returned to Berkeley to teach and do full-time math research, selling his Axcom shares at a price that amounted to six times what he had paid just sixteen months earlier…

“It never occurred to me that we’d go through the roof,” Berlekamp says.

CHAPTER SEVEN

Zuckerman writes:

Like the technical traders before him, Simons practiced a form of pattern analysis and searched for telltale sequences and correlations in market data. He hoped to have a bit more luck than investors before him by doing his trading in a more scientific manner, however. Simons agreed with Berlekamp that technical indicators were better at guiding short-term trades than long-term investments. But Simons hoped rigorous testing and sophisticated predictive models, based on statistical analysis rather than eyeballing price charts, might help him escape the fate of the chart adherents who had crashed and burned.

But Simons didn’t realize that others were busy crafting similar strategies, some using their own high-powered computers and mathematical algorithms. Several of these traders already had made enormous progress, suggesting that Simons was playing catch-up.

Zuckerman:

Edward Thorp became the first modern mathematician to use quantitative strategies to invest sizable sums of money. Thorp was an academic who had worked with Claude Shannon, the father of information theory, and embraced the proportional betting system of John Kelly, the Texas scientist who had influenced Elwyn Berlekamp.

By the late 1980s, Thorp’s fund had $300 million under management, while Simons’s Medallion fund had only $25 million. Thorp’s fund traded warrants, options, convertible bonds, and other derivative securities.

I wrote about Thorp’s autobiography,A Man for All Markets, here: https://boolefund.com/man-for-all-markets/

***

Gerry Bamburger, a computer-science graduate of Columbia University, gave technical support to Morgan Stanley’s stock traders. Zuckerman:

Bamburger sensed opportunity. If the bank created a database tracking the historic prices of various paired stocks, it could profit simply by betting on the return of these price-spreads to their historic levels after block trades or other unusual activity. Bamburger’s bosses were swayed, setting him up with half a million dollars and a small staff. Bamburger began developing computer programs to take advantage of “temporary blips” of paired shares… By 1985, he was implementing his strategy with six or seven stocks at a time, while managing $30 million, scoring profits for Morgan Stanley.

Morgan Stanley gave Bamburger a new boss: Nunzio Tartaglia, an astrophysicist. This prompted Bamburger to quit Morgan Stanley and join Ed Thorp’s hedge fund.

Meanwhile, Tartaglia renamed his group Automated Proprietary Trading (APT). Zuckerman:

New hires, including a former Columbia University computer-science professor named David Shaw and mathematician Robert Frey, improved profits. The Morgan Stanley traders became some of the first to embrace the strategy of statistical arbitrage, or stat arb…. The team’s software ranked stocks by their gains or losses over the previous weeks, for example. APT would then sell short, or bet against, the top 10 percent of the winners within an industry while buying the bottom 10 percent of the losers on the expectation that these trading patterns would revert.

Eventually, APT suffered losses. Morgan Stanley ended up shutting the group down. Zuckerman comments:

It wouldn’t be clear for many years, but Morgan Stanley had squandered some of the most lucrative trading strategies in the history of finance.

***

One of the Medallion fund’s chief competitors was a fund run by David Shaw, who had been a part of Morgan Stanley’s APT group. Zuckerman:

Shaw, a supercomputing expert, hired math and science PhDs who embraced his scientific approach to trading. He also brought on whip-smart employees from different backgrounds. English and philosophy majors were among Shaw’s favorite hires, but he also hired a chess master, stand-up comedians, published writers, an Olympic-level fencer, a trombone player, and a demolitions specialist.

Soon Shaw’s fund became successful and was managing several hundred million dollars. Jim Simons wasn’t sure what methods Shaw was using, but he did realize that he needed to hire more help in order to catch up. Simons contacted Donald Sussman, a hedge-fund manager who had helped Shaw launch his fund. Perhaps Sussman would give Simons a similar boost.

CHAPTER EIGHT

Zuckerman writes about Simons meeting with Sussman:

Simons had discarded a thriving academic career to do something special in the investing world. But, after a full decade in the business, he was managing barely more than $45 million, a mere quarter the assets of Shaw’s firm. The meeting had import–backing from Sussman could help Renaissance hire employees, upgrade technology, and become a force on Wall Street.

Simons’s presentation to Sussman went well. But in the end, because Sussman was the sole source of capital for D. E. Shaw–which was generating 40 percent returns per year–Sussman decided not to invest in Renaissance. Simons approached other potential backers, but no one would invest. Most thought it was crazy to rely on trading models generated by computers. Many also thought Simons’s fees were too high. Simons charged 5 percent of assets plus 20 percent of profits, whereas most hedge funds at the time charged 2 percent of assets plus 20 percent of profits. Perhaps most importantly, Renaissance had fewer than two years of impressive performance.

Simons knew he needed to hire more help. He turned to the mathematician Henry Laufer. Zuckerman:

Joining Stony Brook’s math department in 1971, Laufer focused on complex variables and algebraic geometry, veering away from classical areas of complex analysis to develop insights into more contemporary problems.

In 1992, Laufer joined Simons as a full-time employee. Zuckerman:

Laufer made an early decision that would prove extraordinarily valuable: Medallion would employ a single trading model rather than maintain various models for different investments and market conditions, a style most quantitative firms would embrace. A collection of trading models was simpler and easier to pull off, Laufer acknowledged. But, he argued, a single model could draw on Straus’s vast trove of pricing data, detecting correlations, opportunities, and other signals across various asset classes. Narrow, individual models, by contrast, can suffer from too little data.

Just as important, Laufer understood that a single, stable model based on some core assumptions about how prices and markets behave would make it easier to add new investments later on.

Zuckerman continues:

Simons wondered if there might be a better way to parse their data trove. Perhaps breaking the day up into finer segments might enable the team to dissect intraday pricing information and unearth new, undetected patterns. Laufer… eventually decided five-minute bars were the ideal way to carve things up. Crucially, Straus now had access to improved computer-processing power, making it easier for Laufer to compare small slices of historic data…

Laufer’s five-minute bars gave the team the ability to identify new trends, oddities, and other phenomena, or, in their parlance, nonrandom trading effects. Straus and others conducted tests to ensure they hadn’t mined so deeply into their data that they had arrived at bogus trading strategies, but many of the new signals seemed to hold up.

Zuckerman adds:

Simons was challenging them to solve yet another vexing problem: Given the range of possible trades they had developed and the limited amount of money that Medallion managed, how much should the bet on each trade? And which moves should they pursue and prioritize? Laufer began developing a computer program to identify optimal trades throughout the day, something Simons began calling his betting algorithm. Laufer decided it would be “dynamic,” adapting on its own along the way and relying on real-time analysis to adjust the fund’s mix of holdings given the probabilities of future market moves–an early form of machine learning.

Simons, with about a dozen employees, realized that he still needed to hire more people in order to take on D. E. Shaw and other top funds. One person Simons hired was mathematician and programmer Nick Patterson. His coding ability gave him an advantage over other mathematicians. He graduated from the University of Cambridge.

(Photo by Cristian Saulean)

Patterson was a strong chess player and was also a stud at poker.

(Photo by Krastiu Vasilev)

After completing graduate school, Patterson worked as a cryptologist for the British government, where he made use of Bayes’s theorem of probability.

Because computing power was expanding exponentially, Patterson thought that Simons had a chance to revolutionize investing by applying high-level math and statistics.

Patterson began working on how to reduce trading costs:

…Laufer and Patterson began developing sophisticated approaches to direct trades to various futures exchanges to reduce the market impact of each trade. Now Medallion could better determine which investments to pursue, a huge advantage as it began trading new markets and investments. They added German, British, and Italian bonds, then interest-rate contracts in London, and, later, futures on Nikkei Stock Average, Japanese government bonds, and more.

The fund began trading more frequently. Having first sent orders to a team of traders five times a day, it eventually increased to sixteen times a day, reducing the impact on prices by focusing on the periods when there was the most volume.

Medallion increased 71 percent in 1994. This was especially impressive because the Federal Reserve had hiked interest rates several times, which led to losses for many investors. Simons still didn’t know why their models were working. He told a colleague: “I don’t know why planets orbit the sun. That doesn’t mean I can’t predict them.” Zuckerman:

At the time, most academics were convinced markets were inherently efficient, suggesting that there were no predictable ways to beat the market’s return, and that the financial decision-making of individuals was largely rational. Simons and his colleagues sensed the professors were wrong. They believed investors are prone to cognitive biases, the kinds that lead to panics, bubbles, boom, and busts.

Simons didn’t realize it, but a new strain of economics was emerging that would validate his instincts. In the 1970s, Israeli psychologists Amos Tversky and Daniel Kahneman had explored how individuals make decisions, demonstrating how prone most are to act irrationally. Later, economist Richard Thaler used psychological insights to explain anomalies in investor behavior, spurring the growth of the field of behavioral economics, which explored the cognitive biases of individuals and investors.

Link to my blog post on cognitive biases: https://boolefund.com/cognitive-biases/

(Illustration by Alain Lacroix)

Link to my blog post on the psychology of misjudgment: https://boolefund.com/the-psychology-of-misjudgment/

Simons saw how successful Medallion’s updated approach was, and he remembered how difficult it was for Baum, Ax, and himself to profit from instincts. As a result, Simons committed to not overriding the model. Medallion’s model profited from the errors and overreactions of other investors. Medallion’s core assumption was that investors will behave in the future like they did in the past.

Other investors at long last began noticing Medallion’s stellar results. Some of these investors made an investment in Medallion. By that point, Medallion was sharing its track record, but it wasn’t sharing much about how their trading system worked because it didn’t want rivals to catch on.

By the end of 1993, Medallion had $280 million under management. Simons grew concerned the they wouldn’t be as profitable if they got too big. So he decided, for the time being, not to let new investors into the fund. Furthermore, Simons got even more secretive about Medallion’s trading model. Simons even pressured his investors not to divulge any information about the fund’s operations.

Zuckerman writes:

Medallion was still on a winning streak. It was scoring big profits trading futures contracts and managed $600 million, but Simons was convinced the hedge fund was in a serious bind. Laufer’s models, which measured the fund’s impact on the market with surprising precision, concluded that Medallion’s returns would wane if it managed much more money. Some commodity markets, such as grains, were just too small to handle additional buying and selling by the fund without pushing prices around. There were also limitations to how much more Medallion could do in bigger bond and currency markets.

Moreover:

Simons worried his signals were getting weaker as rivals adopted similar strategies.

Yet Simons continued to search for ways to grow the fund. There was only one way to expand: start investing in stocks. The trouble was that Medallion had never developed any model to invest in stocks profitably.

Simons’s son Paul battled a birth disorder–ectodermal dysplasia. Paul worked almost every day to strengthen his body, constantly doing push-ups and pull-ups. Paul was also an accomplished skier and endurance bicycle rider. One day Paul was taking a fast ride through Old Field Road in Setauket, near the home where he grew up. An elderly woman backed out of her driveway, out of nowhere, and crushed Paul, killing him instantly. Jim Simons and Barbara were completely devastated.

CHAPTER NINE

Zuckerman comments:

When it came to stocks, Simons seemed well out of his depth.

Most successful stock investors at the time focused on fundamentals, poring over financial statements in order to understand things such as assets, liabilities, sales, earnings, and cash flows.

Nick Patterson began a side job he liked: recruiting talent for Renaissance. Zuckerman:

One day, after reading in the morning paper that IBM was slashing costs, Patterson became intrigued. He was aware of the accomplishments of the computer giant’s speech-recognition group and thought their work bore similarity to what Renaissance was doing. In early 1993, Patterson sent separate letters to Peter Brown and Robert Mercer, deputies of the group, inviting them to visit Renaissance’s offices to discuss potential positions.

Zuckerman explains that Robert Mercer’s passion for computers had been sparked by his father Thomas:

It began the very moment Thomas showed Robert the magnetic drum and punch cards of an IBM 650, one of the earliest mass-produced computers. After Thomas explained the computer’s inner workings to his son, the ten-year-old began creating his own programs, filling up an oversize notebook. Bob carried that notebook around for years before he ever had access to an actual computer.

At Sandia High School and the University of New Mexico, Mercer was a member of the chess, auto, and Russian clubs. He was low-key, but he came alive for mathematics. In 1964, he and two classmates won top honors in a national mathematics contest. Zuckerman:

While studying physics, chemistry, and mathematics at the University of New Mexico, Mercer got a job at a weapons laboratory at the Kirkland Air Force Base eight miles away, just so he could help program the base’s supercomputer.

[…]

…Mercer spent the summer on the lab’s mainframe computer rewriting a program that calculated electromagnetic fields generated by nuclear fusion bombs. In time, Mercer found ways to make the program one hundred times faster, a real coup. Mercer was energized and enthused, but his bosses didn’t seem to care about his accomplishment. Instead of running the old computations at the new, faster speed, they instructed Mercer to run computations that were one hundred times the size. It seemed Mercer’s revved-up speed made little difference to them, an attitude that helped mold the young man’s worldview.

[…]

He turned cynical, viewing government as arrogant and inefficient.

Mercer earned a PhD in computer science from the University of Illinois, then joined IBM and its speech-recognition group in 1972.

***

Peter Brown’s father Henry Brown introduced the world’s first money-market mutual fund. Few investors showed any interest, however. Henry worked every day except Christmas in 1972, when Peter was seventeen. Zuckerman:

His lucky break came the next year in the form of a New York Times article about the fledgling fund. Clients began calling, and soon Henry and his partner were managing $100 million in their Reserve Primary Fund. The fund grew, reaching billions of dollars, but Henry resigned, in 1985, to move [with his wife] to the Brown family’s farm in a Virginia hamlet, where he raised cattle on five hundred acres.

Zuckerman continues:

Peter reserved his own ambitions for science and math. After graduating from Harvard University with an undergraduate degree in mathematics, Brown joined a unit of Exxon that was developing ways to translate spoken language into computer text, an early form of speech-recognition technology. Later, he’d earn a PhD in computer science from Carnegie Mellon University in Pittsburgh.

In 1984, Brown joined IBM’s speech-recognition group. Zuckerman:

Brown, Mercer, and their fellow mathematicians and scientists, including the group’s hard-driving leader, Fred Jelinek, viewed language very differently from the traditionalists. To them, language could be modeled like a game of chance. At any point in a sentence, there exists a certain probability of what might come next, which can be estimated based on past, common usage…

Their goal was to feed their computers with enough data of recorded speech and written text to develop a probabilistic, statistical model capable of predicting likely word sequences based on sequences of sounds…

In mathematical terms, Brown, Mercer, and the rest of Jelinek’s team viewed sounds as the output of a sequence in which each step along the way is random, yet dependent on the previous step–a hidden Markov model. A speech-recognition system’s job was to take a set of observed sounds, crunch the probabilities, and make the best possible guess about the “hidden” sequences of words that could have generated those sounds. To do that, the IBM researchers employed the Baum-Welch algorithm–codeveloped by Jim Simons’s early trading partner Lenny Baum–to zero in on the various language probabilities. Rather than manually programming in static knowledge about how language worked, they created a program that learned from data.

Mercer jumped rope to stay in shape. He had a hyper-efficient style of communication, usually saying nothing and otherwise saying only a few words. Brown, by contrast, was more approachable and animated.

Jelinek created a ruthless and fierce culture. Zuckerman:

Researchers would posit ideas and colleagues would do everything they could to eviscerate them, throwing personal jabs along the way. They’d fight it out until reaching a consensus on the merits of the suggestion… It was no-holds-barred intellectual combat.

…Brown stood out for having unusual commercial instincts, perhaps the result of his father’s influence. Brown urged IBM to use the team’s advances to sell new products to customers, such as a credit-evaluation service, and even tried to get management to let them manage a few billion dollars of IBM’s pension-fund investments with their statistical approach, but failed to garner much support.

[…]

At one point, Brown learned of a team of computer scientists, led by a former Carnegie Mellon classmate, that was programming a computer to play chess. He set out to convince IBM to hire the team. One winter day, while Brown was in an IBM men’s room, he got to talking with Abe Peled, a senior IBM research executive, about the exorbitant cost of the upcoming Super Bowl’s television commercials. Brown said he had a way to get the company exposure at a much lower cost–hire the Carnegie Mellon team and reap the resulting publicity when their machine beat a world champion in chess…

The IBM brass loved the idea and hired the team, which brought its Deep Thought program along.

Mercer was skeptical that hedge funds create good for society. But he agreed to visit Renaissance and he was impressed that the company seemed to be about science. Also, both Mercer and Brown were not paid much at IBM. Brown, for his part, became more interested when he learned that Simons’s had worked with Lenny Baum, coinventor of the Baum-Welch algorithm.

Simons offered to double their salaries. Mercer and Brown joined Renaissance in 1993.

CHAPTER TEN

Brown suggested that Renaissance interview David Magerman, whom Brown knew from IBM. Magerman’s specialty was programming, which Renaissance needed. Soon Renaissance hired Magerman.

Magerman had a difficult upbringing, growing up without much money. His father was a math whiz who’d never been able to develop his talents. He took it out on his son. Magerman was left with a desire to earn praise from people in power, some of whom Magerman saw as father figures. He also seemed to pick fights unnecessarily. Zuckerman:

“I needed to right wrongs and fight for justice, even if I was turning molehills into mountains,” Magerman acknowledges. “I clearly had a messiah complex.”

Magerman studied mathematics and computer science at the University of Pennsylvania. He excelled. Zuckerman:

At Stanford University, Magerman’s doctoral thesis tackled the exact topic Brown, Mercer, and other IBM researchers were struggling with: how computers could analyze and translate language using statistics and probability.

Although Simons had initially had Brown and Mercer working in different areas of Renaissance, the pair had been working together in their spare time on how to fix Renaissance’s stock-trading system. Soon Mercer figured out the key problem. Simons let Mercer join Brown in the stock-research area. Zuckerman:

The Brown-Mercer reunion represented a new chapter in an unusual partnership between two scientists with distinct personalities who worked remarkably well together. Brown was blunt, argumentative, persistent, loud, and full of energy. Mercer conserved his words and rarely betrayed emotion, as if he was playing a never-ending game of poker. The pair worked, though, yin with yang.

[…]

…[While at IBM, they] developed a certain work style–Brown would quickly write drafts of their research and then pass them to Mercer, a much better writer, who would begin slow and deliberate rewrites.

Brown and Mercer threw themselves into their new assignment [to revamp Renaissance’s stock-trading model.] They worked late into the evening and even went home together; during the week they shared a living space in the attic of a local elderly woman’s home, returning to their families on weekends. Over time, Brown and Mercer discovered methods to improve Simons’s stock-trading system.

Zuckerman:

[Brown and Mercer] decided to program the necessary limitations and qualifications into a single trading system that could automatically handle all potential complications. Since Brown and Mercer were computer scientists, and they had spent years developing large-scale software projects at IBM and elsewhere, they had the coding chops to build a single automated system for trading stocks.

[…]

Brown and Mercer treated their challenge as a math problem, just as they had with language recognition at IBM. Their inputs were the fund’s trading costs, its various leverages, risk parameters, and assorted other limitations and requirements. Given all those factors, they built the system to solve and construct an ideal portfolio, making optimal decisions, all day long, to maximize returns.

Zuckerman writes:

The beauty of the approach was that, by combining all their trading signals and portfolio requirements into a single, monolithic model, Renaissance could easily test and add new signals, instantly knowing if the gains from a potential new strategy were likely to top its costs. They also made their system adaptive, or capable of learning and adjusting on its own…

If the model’s recommended trades weren’t executed, for whatever reason, it self-corrected, automatically searching for buy-or-sell orders to nudge the portfolio back where it needed to be… The system repeated on a loop several times an hour, conducting an optimization process that weighed thousands of potential trades before issuing electronic trade instructions. Rivals didn’t have self-improving models; Renaissance now had a secret weapon, one that would prove crucial to the fund’s future success.