Value investing can be a relatively low risk way for some investors to beat the market over time. Yet it often takes a decade to get the hang of it. Even then, you have to keep improving indefinitely. But the great thing is that you can keep improving indefinitely as long as your health stays good. In addition to learning from experience, an excellent way to progress is by studying the best value investors.

Howard Marks is not only a great value investor. But he also has written an outstanding book, The Most Important Thing: Uncommon Sense for the Thoughtful Investor (Columbia University Press, 2011). Like most classics, Marks’s book is worth re-reading periodically.

This blog post is intended for two groups:

- People who already have some experience with value investing. It’s worth regularly reviewing the teachings of the masters.

- People who are interested in learning about value investing.

Here’s an outline. Each section can be read independently:

- A Value Investing Philosophy

- Second-Level Thinking

- Understanding Market Efficiency

- Value

- The Relationship Between Price and Value

- Understanding Risk

- Recognizing Risk

- Controlling Risk

- Being Attentive to Cycles

- Awareness of the Pendulum

- Combating Negative Influences

- Contrarianism

- Finding Bargains

- Patient Opportunism

- Knowing What You Don’t Know

- Having a Sense of Where We Stand

- Appreciating the Role of Luck

- Investing Defensively

The title of the book is based on the fact that Marks wrote a series of memos to clients identifying “the most important thing.” Looking back, Marks realized that there were many “most important things.”

The thing I find most interesting about investing is how paradoxical it is: how often the things that seem most obvious–on which everyone agrees–turn out not to be true. – Howard Marks

A VALUE INVESTING PHILOSOPHY

A value investing philosophy takes time to develop, as Marks notes:

A philosophy has to be the sum of many ideas accumulated over a long period of time from a variety of sources. One cannot develop an effective philosophy without having been exposed to life’s lessons. In my life I’ve been quite fortunate in terms of both rich experiences and powerful lessons.

…

Good times teach only bad lessons: that investing is easy, that you know its secrets, and that you needn’t worry about risk. The most valuable lessons are learned in tough times.

(Photo by Yuryz)

SECOND-LEVEL THINKING

Marks first points out how variable the investing landscape is:

No rule always works. The environment isn’t controllable, and circumstances rarely repeat exactly. Psychology plays a major role in markets, and because it’s highly variable, cause-and-effect relationships aren’t reliable.

The goal for an investor is to do better than the market over time. Otherwise, the best option for most investors is simply to buy and hold low-cost broad market index funds. Doing better than the market requires an identifiable edge:

Since other investors may be smart, well-informed and highly computerized, you must find an edge they don’t have. You must think of something they haven’t thought of, see things they miss or bring insight they don’t possess. You have to react differently and behave differently. In short, being right may be a necessary condition for investment success, but it won’t be sufficient. You must be more right than others… which by definition means your thinking has to be different.

(Photo by Andreykuzmin)

Marks gives some examples of second-level thinking:

First-level thinking says, ‘It’s a good company; let’s buy the stock.’ Second-level thinking says, ‘It’s a good company, but everyone thinks it’s a great company, and it’s not. So the stock’s overrated and overpriced; let’s sell.’

First-level thinking says, ‘The outlook calls for low growth and rising inflation. Let’s dump our stocks.’ Second-level thinking says, ‘The outlook stinks, but everyone else is selling in panic. Buy!’

First-level thinking says, ‘I think the company’s earnings will fall; sell.’ Second-level thinking says, ‘I think the company’s earnings will fall less than people expect, and the pleasant surprise will lift the stock; buy.’

Marks explains that first-level thinking is generally simplistic. By contrast, second-level thinking requires thinking of the full range of possible future outcomes, along with estimating probabilities for each possible outcome. Second-level thinking means understanding what the consensus thinks, why you have a different view, and the likelihood that one’s contrarian view is correct. Marks observes that second-level thinking is far more difficult than first-level thinking, thus few investors truly engage in second-level thinking. First-level thinkers cannot expect to outperform the market.

To outperform the average investor, you have to be able to outthink the consensus. Are you capable of doing so? What makes you think so?

UNDERSTANDING MARKET EFFICIENCY

Marks holds a view of market efficiency similar to that of Warren Buffett: The market is usually efficient, but it is far from always efficient.

(Illustration by Lancelotlachartre)

Marks says that the market reflects the consensus view, but the consensus is not always right:

In January 2000, Yahoo sold at $237. In April 2001 it was $11. Anyone who argues that the market was right both times has his or her head in the clouds; it has to have been wrong on at least one of those occasions. But that doesn’t mean many investors were able to detect and act on the market’s error.

Marks summarizes his view:

The bottom line for me is that, although the more efficient markets often misvalue assets, it’s not easy for any one person–working with the same information as everyone else and subject to the same psychological influences–to consistently hold views that are different from the consensus and closer to being correct. That’s what makes the mainstream markets awfully hard to beat–even if they aren’t always right.

Marks makes an important point about riskier investments:

Once in a while we experience periods when everything goes well and riskier investments deliver the higher returns they seem to promise. Those halcyon periods lull people into believing that to get higher returns, all they have to do is make riskier investments. But they ignore something that is easily forgotten in good times: this can’t be true, because if riskier investments could be counted on to produce higher returns, they wouldn’t be riskier.

Marks notes that inefficient prices imply that for each investor who buys at a cheap price, another investor must sell at that cheap price. Inefficiency essentially implies that each investment that beats the market implies another investment that trails the market by an equal amount.

Generally it is exceedingly difficult to beat the market. To highlight this fact, Marks asks a series of questions:

- Why should a bargain exist despite the presence of thousands of investors who stand ready and willing to bid up the price of anything that is too cheap?

- If the return appears so generous in proportion to the risk, might you be overlooking some hidden risk?

- Why would the seller of the asset be willing to part with it at a price from which it will give you an excessive return?

- Do you really know more about the asset than the seller does?

- If it’s such a great proposition, why hasn’t someone else snapped it up?

Market inefficiency alone, argues Marks, is not a sufficient condition for outperformance:

All that means is that prices aren’t always fair and mistakes are occurring: some assets are priced too low and some too high. You still have to be more insightful than others in order to regularly buy more of the former than the latter. Many of the best bargains at any point in time are found among the things other investors can’t or won’t do.

(Photo byMarijus Auruskevicius)

Marks ends this section by saying that a key turning point in his career was when he concluded that he should focus on relatively inefficient markets.

Important Note: One area of the stock market that is remarkably inefficient is microcap stocks, especially when compared with midcap or largecap stocks. See:https://boolefund.com/cheap-solid-microcaps-far-outperform-sp-500/

A few comments about deep value investing:

In order to buy a stock that is very cheap in relation to its intrinsic value, some other investor must be willing to sell the stock at such an irrationally low price. Sometimes such sales happen due to forced selling. The rest of the time, the seller must be making a mistake in order for the value investor to make a market-beating investment.

And yet many deep value approaches are fully quantitative, relying on statistical rules for stock selection. The quantitative deep value investor does not typically make a detailed judgment on each individual stock–a judgment which would imply that the buyer is correct and the seller is incorrect in the individual case. Rather, the quantitative deep value investor forms a portfolio of the statistically cheapest stocks. All of the studies have shown that a basket of quantitatively cheap stocks does better than the market over time, and is less risky (especially during down markets).

Blog post on quantitative deep value investing:https://boolefund.com/quantitative-deep-value-investing/

A concentrated deep value approach, by contrast, involves the effort to select the most promising and the cheapest individual stocks available. Warren Buffett and Charlie Munger–both inspired in part by Philip Fisher–followed this approach when they were managing smaller amounts of capital. They would usually have between 3 and 8 positions making up nearly the entire portfolio.

VALUE

Marks begins by saying that “buy low; sell high” is one of the oldest rules in investing. But since selling will occur in the future, how can you figure out a price today that will be lower than some future price? What’s needed is an ability to accurately assess the intrinsic value of the asset. The intrinsic value of a stock can be derived from the price that an informed buyer would pay for the entire company, based on net asset value or normalized earnings. Writes Marks:

The quest in value investing is for cheapness. Value investors typically look at financial metrics such as earnings, cash flow, dividends, hard assets and enterprise value and emphasize buying cheap on these bases. The primary goal of value investors, then, is to quantify the company’s current value and buy its securities when they can do so cheaply.

(Photo by Farang)

Marks notes that a successful value investment requires a non-consensus view on net asset value or normalized earnings. Successful growth investing, by contrast, requires a non-consensus view on future earnings (based on growth). Sometimes the rewards for growth investing are higher, but a value investing approach is much more repeatable and achievable.

Buying assets below fair value, however, does not mean those assets will outperform right away. Value investing requires having a firmly held view because quite often after buying, cheap assets will continue to underperform the market. Marks elaborates:

If you liked it at 60, you should like it more at 50… and much more at 40 and 30. But it’s not that easy. No one’s comfortable with losses, and eventually any human will wonder, ‘Maybe it’s not me who’s right. Maybe it’s the market.’…

Thus, successful value investing requires not only the consistent ability to identify assets available at cheap prices; it also requires the ability to ignore various signals (many of which are subconscious) flashing the message that one is wrong. As Marks writes:

Value investors score their biggest gains when they buy an underpriced asset, average down unfailingly and have their analysis proved out. Thus, there are two essential ingredients for profit in a declining market: you have to have a view on intrinsic value, and you have to hold that view strongly enough to be able to hang in and buy even as price declines suggest that you’re wrong. Oh yes, there’s a third: you have to be right.

THE RELATIONSHIP BETWEEN PRICE AND VALUE

Many investors make the mistake of thinking that a good company is automatically a good investment, while a bad company is automatically a bad investment. But what really matters for the value investor is the relationship between price and value:

For a value investor, price has to be the starting point. It has been demonstrated time and time again that no asset is so good that it can’t become a bad investment if bought at too high a price. And there are few assets so bad that they can’t be a good investment when bought cheaply enough.

In the 1960’s, there was a group of stocks called the Nifty Fifty–companies that were viewed as being so good that all you had to do was buy at any price and then hold for the long term. But it turned out not to be true for many stocks in the basket. Moreover, the early 1970’s led to huge declines:

Within a few years, those price/earnings ratios of 80 or 90 had fallen to 8 or 9, meaning investors in America’s best companies had lost 90 percent of their money. People may have bought into great companies, but they paid the wrong price.

Marks explains the policy at his firm Oaktree:

‘Well bought is half sold.’ By this we mean we don’t spend a lot of time thinking about what price we’re going to be able to sell a holding for, or to whom, or through what mechanism. If you’ve bought it cheap, eventually those questions will answer themselves. If your estimate of intrinsic value is correct, over time an asset’s price should converge with its value.

Marks, similar to Buffett and Munger, holds that psychology plays a central role in value investing:

Whereas the key to ascertaining value is skilled financial analysis, the key to understanding the price/value relationship–and the outlook for it–lies largely in insight into other investor’s minds. Investor psychology can cause a security to be priced just about anywhere in the short run, regardless of its fundamentals.

…

The safest and most potentially profitable thing is to buy something when no one likes it. Given time, its popularity, and thus its price, can only go one way: up.

A successful value investor must build systems or rules for self-protection because all investors–all humans–suffer from cognitive biases, which often operate subconsciously.

(Illustration by Alain Lacroix)

- My brief summary of key cognitive biases:https://boolefund.com/cognitive-biases/

- A more detailed treatment of biases by Charlie Munger:https://boolefund.com/the-psychology-of-misjudgment/

Marks again on the importance of cheapness:

Of all the possible routes to investment profit, buying cheap is clearly the most reliable. Even that, however, isn’t sure to work. You can be wrong about the current value. Or events can come along that reduce value. Or deterioration in attitudes or markets can make something sell even further below its value. Or the convergence of price and intrinsic value can take more time than you have…

Trying to buy below value isn’t infallible, but it’s the best chance we have.

UNDERSTANDING RISK

As Buffett frequently observes, the future is always uncertain. Prices far below probable intrinsic value usually only exist when the future is highly uncertain. When there is not much uncertainty, asset prices will be much higher than otherwise. So high uncertainty about the future is the friend of the value investor.

(Photo by Alain Lacroix)

On the other hand, in general, assets that promise higher returns entail higher risk. If a potentially higher-returning asset was obviously as low risk as a U.S. Treasury, then investors would rush to buy the higher-returning asset, thereby pushing up its price to the point where it would promise returns on par with a U.S. Treasury.

A successful value investor has to determine whether the potential return on an ostensibly cheap asset is worth the risk. High risk is not necessarily bad as long as it is properly controlled and as long as the potential return is high enough. But if the risk is too high, then it’s not the type of repeatable bet that can produce long-term success for a value investor. Repeatedly taking too much risk virtually guarantees long-term failure.

Consider the Kelly criterion. If the probability of success and the returns from a potential investment can be quantified, then the Kelly criterion tells you exactly how much to bet in order to maximize the long-term compound returns from a long series of such bets. Betting any other amount than what the Kelly criterion says will inevitably lead to less than the maximum potential returns. Most importantly, betting more than what the Kelly criterion says guarantees negative long-term returns. Repeatedly overbetting guarantees long-term failure.

This is part of why Howard Marks, Warren Buffett, Charlie Munger, Seth Klarman and other great value investors often point out that minimizing big mistakes is more important for long-term success in investing than hitting home runs.

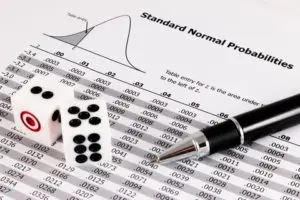

Again, while riskier investments promise higher returns, those higher returns are not guaranteed, otherwise riskier investments wouldn’t be riskier! The probability distribution of potential returns is wider for riskier investments, typically including some large potential losses. A certain percentage of future outcomes will be negative for riskier investments.

(Photo by Wittayayut Seethong)

Marks agrees with Buffett and Munger that the best definition of risk is the potential to experience loss.

Of course, even the best investors are generally right only two-thirds of the time, while they are wrong one-third of the time. Thus, following a successful long-term value investing framework where you consistently and carefully pays cheap prices for assets still entails being wrong once every three tries, whether due to a mistake, bad luck, or unforeseen events.

More Notes on Deep Value

Investors are systematically too pessimistic about companies that have been doing poorly, and systematically too optimistic about companies that have been doing well. This is why a deep value approach, if applied systematically, is very likely to produce market-beating returns over a long enough period of time.

Marks explains:

Dull, ignored, possibly tarnished and beaten-down securities–often bargains exactly because they haven’t been performing well–are often ones value investors favor for high returns…. Much of the time, the greatest risk in these low-luster bargains lies in the possibility of underperforming in heated bull markets. That’s something the risk-conscious value investor is willing to live with.

Measuring Risk-Adjusted Returns

Marks mentions the Sharpe ratio–or excess return compared to the standard deviation of the return. While far from perfect, the Sharpe ratio is a solid measure of risk-adjusted return for many public market securities.

It’s important to point out again that risk can no more be objectively measured after an investment than it can be objectively measured before the investment. Marks:

The point is that even after an investment has been closed out, it’s impossible to tell how much risk it entailed. Certainly the fact that an investment worked doesn’t mean it wasn’t risky, and vice versa. With regard to a successful investment, where do you look to learn whether the favorable outcome was inescapable or just one of a hundred possibilities (many of them unpleasant)? And ditto for a loser: how do we ascertain whether it was a reasonable but ill-fated venture, or just a wild stab that deserved to be punished?

Did the investor do a good job of assessing the risk entailed? That’s another good question that’s hard to answer. Need a model? Think of the weatherman. He says there’s a 70 percent chance of rain tomorrow. It rains; was he right or wrong? Or it doesn’t rain; was he right or wrong? It’s impossible to assess the accuracy of probability estimates other than 0 and 100 except over a very large number of trials.

Marks believes (as do Buffett, Munger, and other top value investors) that there is some merit to the expected value framework whereby you attempt to identify possible future scenarios and the probabilities of their occurrence:

If we have a sense for the future, we’ll be able to say which outcome is most likely, what other outcomes also have a good chance of occurring, how broad the range of possible outcomes is and thus what the ‘expected result’ is. The expected result is calculated by weighing each outcome by its probability of occurring; it’s a figure that says a lot–but not everything–about the likely future.

Again, though, having a reasonable estimate of the future probability distribution is not enough. You must also make sure that your portfolio can withstand a run of bad luck; and you must recognize when you have experienced a run of good luck. Marks quotes his friend Bruce Newberg (with whom he has played cards and dice): “There’s a big difference between probability and outcome. Probable things fail to happen–and improbable things happen–all the time.” This is one of the most important lessons to know about investing, asserts Marks.

(via Wikimedia Commons)

Marks defines investment performance in the context of risk:

… investment performance is what happens when a set of developments–geopolitical, macro-economic, company-level, technical and psychological–collide with an extant portfolio. Many futures are possible, to paraphrase Dimson, but only one future occurs. The future you get may be beneficial to your portfolio or harmful, and that may be attributable to your foresight, prudence or luck. The performance of your portfolio under the one scenario that unfolds says nothing about how it would have fared under the many ‘alternative histories’ that were possible.

A portfolio can be set up to withstand 99 percent of all scenarios but succumb because it’s the remaining 1 percent that materializes. Based on the outcome, it may seem to have been risky, whereas the investor might have been quite cautious.

Another portfolio may be structured so that it will do very well in half the scenarios and very poorly in the other half. But if the desired environment materializes and it prospers, onlookers can conclude that it was a low-risk portfolio.

The success of a third portfolio can be entirely contingent on one oddball development, but if it occurs, wild aggression can be mistaken for conservatism and foresight.

It’s tough to quantify risk without a large number of repeated trials under similar circumstances. Marks:

Risk can be judged only by sophisticated, experienced second-level thinkers.

The past seems very definite: for every evolving set of possible scenarios, only one scenario happened at each point along the way. But that does not at all mean that the scenarios that actually occurred were the only scenarios that could have occurred.

Furthermore, most people assume that the future will be like the past, especially the more recent past. As Ray Dalio suggests, the biggest mistake most investors make is to assume that the recent past will continue into the future.

Marks also reminds us that the “worst-case” assumed by most investors is typically not negative enough. Marks relates a funny story his father told about a gambler who bet everything on a race with only one horse in it. How could he lose? “Halfway around the track, the horse jumped over the fence and ran away. Invariably things can get worse than people expect.” Taking more risk usually leads to higher returns, but not always. “And when risk bearing doesn’t work, it really doesn’t work, and people are reminded what risk’s all about.”

RECOGNIZING RISK

(Photo by Shawn Hempel)

The main source of risk, argues Marks, is high prices. When stock prices move higher, for instance, most investors feel more optimistic and less concerned about downside risk. But value investors have the opposite point of view: risk is typically very low when stock prices are very low, while risk tends to increase significantly when stock prices have increased significantly.

Most investors are not value investors:

So a prime element in risk creation is a belief that risk is low, perhaps even gone altogether. That belief drives up prices and leads to the embrace of risky actions despite the lowness of prospective returns.

Marks emphasizes that recognizing risk–which comes primarily from high prices–has nothing to do with predicting the future, which cannot be done with any sort of consistency when it comes to the overall stock market or the economy.

Marks also highlights, again, how the psychology of eager buyers–who are unworried about risk–is precisely what creates greater levels of risk as they drive prices higher:

Thus, the market is not a static arena in which investors operate. It is responsive, shaped by investors’ own behavior. Their increasing confidence creates more that they should worry about, just as their rising fear and risk aversion combine to widen risk premiums at the same time as they reduce risk. I call this the ‘perversity of risk.’

In a nutshell:

When everyone believes something is risky, their unwillingness to buy usually reduces its price to the point where it’s not risky at all. Broadly negative opinion can make it the least risky thing, since all optimism has been driven out of its price.

And, of course, as demonstrated by the experience of Nifty Fifty investors, when everyone believes something embodies no risk they usually bid it up to the point where it’s enormously risky. No risk is feared, and thus no reward for risk bearing–no ‘risk premium’–is demanded or provided. That can make the thing that’s most esteemed the riskiest.

This paradox exists because most investors think quality, as opposed to price, is the determinant of whether something’s risky. But high quality assets can be risky, and low quality assets can be safe. It’s just a matter of the price paid for them…

CONTROLLING RISK

Outstanding investors, in my opinion, are distinguished at least as much for their ability to control risk as they are for generating return.

Great investors generate high returns with moderate risk, or moderate returns with low risk. If they generate high returns with “high risk,” but they do so consistently for many years, then perhaps the high risk “either wasn’t really high or was exceptionally well-managed.” Mark says that great investors such as Buffett or Peter Lynch tend to have very few losing years over a relatively long period of time.

It’s important, notes Marks, to see that risk leads to loss only when lower probability negative scenarios occur:

… loss is what happens when risk meets adversity. Risk is the potential for loss if things go wrong. As long as things go well, loss does not arise. Risk gives rise to loss only when negative events occur in the environment.

We must remember that when the environment is salutary, that is only one of the environments that could have materialized that day (or that year). (This is Nassim Nicholas Taleb’s idea of alternative histories…) The fact that the environment wasn’t negative does not mean that it couldn’t have been. Thus, the fact that the environment wasn’t negative doesn’t mean risk control wasn’t desirable, even though–as things turned out–it wasn’t needed at that time.

The absence of losses does not mean that there was no risk.

(Photo by Michele Lombardo)

Only a skilled investor can look at a portfolio during good times and tell how much risk has been taken.

Bottom line: risk control is invisible in good times but still essential, since good times can so easily turn into bad times.

Marks says that an investment manager adds value by generating higher than market returns for a given level of risk. Achieving the same return as the market, but with less risk, is adding value. Achieving better than market returns without undue risk is also adding value.

Many value investors, such as Marks and Buffett, somewhat underperform during up markets, but far outperform during down markets. The net result over a long period of time is market-beating performance with very little incremental risk. But it does take some time in order to see the value added.

Controlling the risk in your portfolio is a very important and worthwhile pursuit. The fruits, however, come only in the form of losses that don’t happen. Such what-if calculations are difficult in placid times.

On the other hand, the intelligent acceptance of recognized risk for profit underlies some of the wisest, most profitable investments–even though (or perhaps due to the fact that) most investors dismiss them as dangerous speculations.

Marks’ firm Oaktree invests in high yield bonds. High yield bonds can be good investments over time if the prices are low enough:

I’ve said for years that risky assets can make for good investments if they’re cheap enough. The essential element is knowing when that’s the case. That’s it: the intelligent bearing of risk for profit, the best test for which is a record of repeated success over a long period of time.

Risk bearing per se is neither wise nor unwise, says Marks. Investing in the more aggressive niches with risk properly controlled is ideal. But controlling risk always entails being prepared for bad scenarios.

Extreme volatility and loss surface only infrequently. And as time passes without that happening, it appears more and more likely that it’ll never happen–that assumptions regarding risk were too conservative. Thus, it becomes tempting to relax rules and increase leverage. And often this is done just before the risk finally rears its head…

Marks quotes Nassim Taleb:

Reality is far more vicious than Russian roulette. First, it delivers the fatal bullet rather infrequently, like a revolver that would have hundreds, even thousands of chambers instead of six. After a few dozen tries, one forgets about the existence of the bullet, under a numbing false sense of security… Second, unlike a well-defined precise game like Russian roulette, where the risks are visible to anyone capable of multiplying and dividing by six, one does not observe the barrel of reality… One is thus capable of unwittingly playing Russian roulette–and calling it by some alternative ‘low risk’ name.

A good example, which Marks does mention, is large financial institutions in 2004-2007. Virtually no one thought that home prices could decline on a nationwide scale, since they had never done so before.

Of course, it’s also possible to be too conservative.

You can’t run a business on the basis of worst-case assumptions. You wouldn’t be able to do anything. And anyway, a ‘worst-case assumption’ is really a misnomer; there’s no such thing, short of a total loss. Now, we know the quants shouldn’t have assumed there couldn’t be a nationwide decline in home prices. But once you grant that such a decline can happen… what should you prepare for? Two percent? Ten? Fifty?

(Photo by Donfiore)

Marks continues:

If every portfolio was required to be able to withstand declines on the scale we’ve witnessed this year [2008], it’s possible no leverage would ever be used. Is that a reasonable reaction?

…

Even if we realize that unusual, unlikely things can happen, in order to act we make reasoned decisions and knowingly accept that risk when well paid to do so. Once in a while, a ‘black swan’ will materialize. But if in the future we always said, ‘We can’t do such-and-such, because the outcome could be worse than we’ve ever seen before,’ we’d be frozen in inaction.

Marks sums it up:

… It’s by bearing risk when we’re well paid to do so–and especially by taking risks toward which others are averse in the extreme–that we strive to add value for our clients.

BEING ATTENTIVE TO CYCLES

- Rule number one: most things will prove to be cyclical.

- Rule number two: some of the greatest opportunities for gain and loss come when other people forget rule number one.

Marks explains:

… processes in fields like history and economics involve people, and when people are involved, the results are variable and cyclical. The main reason for this, I think, is that people are emotional and inconsistent, not steady and clinical.

Objective factors do play a large part in cycles, of course–factors such as quantitative relationships, world events, environmental changes, technological developments and corporate decisions. But it’s the application of psychology to these things that causes investors to overreact or underreact, and thus determines the amplitude of the cyclical fluctuations.

(Image by Anhluong.tdnb, via Wikimedia Commons)

Because people inevitably overreact or underreact, both business activity and stock prices overshoot on the upside and on the downside:

Economies will wax and wane as consumers spend more or less, responding emotionally to economic factors or exogenous events, geopolitical or naturally occurring. Companies will anticipate a rosy future during the up cycle and thus overexpand facilities and inventories; these will become burdensome when the economy turns down. Providers of capital will be too generous when the economy’s doing well, abetting overexpansion with cheap money, and then they’ll pull the reins too tight when things cease to look as good. Investors will overvalue companies when they’re doing well and undervalue them when things get difficult.

AWARENESS OF THE PENDULUM

Marks holds that there are two risks in investing:

- the risk of losing money

- the risk of missing opportunity

Most investors consistently do the wrong thing at the wrong time: when prices are high, most investors rush to buy; when prices are low, most investors rush to sell. Thus, the value investor can profit over time by following Warren Buffett’s advice:

Be fearful when others are greedy. Be greedy when others are fearful.

Marks:

Stocks are cheapest when everything looks grim. The depressing outlook keeps them there, and only a few astute and daring bargain hunters are willing to take new positions.

COMBATING NEGATIVE INFLUENCES

(Photo by Nikki Zalewski)

Like Buffett and Munger, Marks believes that temperament, or the ability to master your emotions, is more important than intellect for success in investing:

Many people possess the intellect needed to analyze data, but far fewer are able to look more deeply into things and withstand the powerful influence of psychology. To say this another way, many people will reach similar cognitive conclusions from their analysis, but what they do with those conclusions varies all over the lot because psychology influences them differently. The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological. Investor psychology includes many separate elements, which we will look at in this chapter, but the key thing to remember is that they consistently lead to incorrect decisions. Much of this falls under the heading of ‘human nature.’

Marks writes about the following psychological tendencies:

- Greed

- Fear

- Self-deception

- Conformity to the crowd

- Envy

- Ego or overconfidence

- Capitulation

How might these psychological tendencies have been useful in our evolutionary history?

When food was often scarce, being greedy by hoarding food made sense. When a movement in the grass frequently meant the presence of a dangerous predator, immediate fear–triggered by the amygdala even before the conscious mind is aware of it–was essential for survival. When hunting for food was dangerous, often with low odds of success, self-deception–accompanied by various naturally occurring chemicals–helped hunters to persevere over long periods of time, regardless of danger and injury. (Chemical reactions would cause an injured hunter not to feel much pain.) If everyone in your tribe was running away as fast as possible, following the crowd was usually the most rational response. If a starving hunter saw another person with a huge pile of food, envy would trigger a strong desire to possess it. This would often lead to a hunting expedition with a heightened level of determination. When hunting a dangerous prey, with low odds of success, ego or overconfidence would cause the hunter to be convinced that he would succeed. From the point of view of the community, having self-deceiving and overconfident hunters was a net benefit because the hunters would persevere despite difficulties, injuries, and even deaths.

How do these psychological tendencies cause people to make errors in modern activities such as investing?

Greed causes people to follow the crowd by paying high prices for stocks in the hope that there will be even higher prices in the future. Fear causes people to sell or to avoid ugly stocks–stocks trading at low multiples because the businesses in question are facing major difficulties.

As humans, we have an amazingly strong tendency towards self-deception:

- The first principle is that you must not fool yourself, and you are the easiest person to fool. – Richard Feynman

- Nothing is easier than self-deceit. For what each man wishes, that he also believes to be true. – Demosthenes, as quoted by Charlie Munger

There have been many times in history when self-deception was probably crucial for the survival of a given individual or community. I’ve mentioned hunters pursuing dangerous prey. A much more recent example might be Winston Churchill, who was firmly convinced–even when virtually all the evidence was against it–that England would defeat Germany in World War II. Churchill’s absolute belief helped sustain England long enough for both good luck and aid to arrive: the Germans ended up overextended in Russia, and huge numbers of American troops (along with mass amounts of equipment) arrived in England.

Thus, like other psychological tendencies, self-deception often plays a constructive role. However, when it comes to investing, self-deception is generally harmful, especially as the time horizon is extended so that luck virtually disappears.

Conformity to the crowd is another psychological tendency that many (if not most) investors seem to display. Marks notes the famous experiment by Solomon Asch. The subject is shown lines of obviously different lengths. But in the same room with the subject are shills, who unbeknownst to the subject have already been instructed to say that two lines of obviously different lengths actually have the same length. So the subject of the experiment has to decide between the obvious evidence of his eyes–the two lines are clearly different lengths–and the opinion of the crowd. A significant number (36.8 percent) ignored their own eyes and went with the crowd, saying that the two lines had equal length, despite the obvious fact that they didn’t.

(The experiment involved a control group in which there were no shills. Almost every subject–over 99 percent–gave the correct answer under these circumstances.)

Greed, conformity, and envy together operate powerfully on the brains of many investors:

Time and time again, the combination of pressure to conform and the desire to get rich causes people to drop their independence and skepticism, overcome their innate risk aversion and believe things that don’t make sense.

A good example from history is the tulip mania in Holland, during which otherwise rational people ended up paying exorbitant sums for colorful tulip bulbs. See: https://en.wikipedia.org/wiki/Tulip_mania

At the peak of tulip mania, in March 1637, some single tulip bulbs sold for more than 10 times the annual income of a skilled craftsman.

The South Sea Bubble is another example, during which even the extremely intelligent Isaac Newton, after selling out early for a solid profit, could not resist buying in again as prices seemed headed for the stratosphere. Newton and many others lost huge sums when prices inevitably returned to earth.

Envymay have been useful for hunter-gatherers. But today envy has a very powerful and often negative effect on most human brains. And as Charlie Munger always points out, envy is particularly stupid because it’s a sin that, unlike other sins, is no fun at all. There are many people who could easily learn to be very happy–grateful for blessings, grateful for the wonders of life itself, etc.–who become miserable because they fixate on other people who have more of something, or who are doing better in some way. Envy is fundamentally irrational and stupid, but it is powerful enough to consume many people. Buffett: “It’s not greed that drives the world, but envy.” Envy and jealousy have caused the downfall of human beings for millenia. This certainly holds true in investing.

Ego and overconfidence are powerful psychological tendencies that humans have. Overconfidence will kill any investor eventually. The antidote is humility and objectivity. Many of the best investors–from Warren Buffett to Ray Dalio–are fundamentally humble and objective. And women tend to be better investors than men on the whole because women are not as overconfident. Marks writes:

[Thoughtful] investors can toil in obscurity, achieving solid gains in the good years and losing less than others in the bad years. They avoid sharing in the riskiest behavior because they’re so aware of how much they don’t know and because they have their egos in check. This, in my opinion, is the greatest formula for long-term wealth creation–but it doesn’t provide much ego gratification in the short run. It’s just not that glamorous to follow a path that emphasizes humility, prudence, and risk control. Of course, investing shouldn’t be about glamour, but often it is.

Capitulation is a final phenomenon that Marks emphasizes. In general, people become overly negative about a stock that is deeply out of favor because the business in question is going through hard times. Moreover, when overly negative investors are filled with fear and when they see everyone selling in a panic, they themselves often sell near the very bottom. Often these investors know analytically that the stock is cheap, but their emotions (fear of loss, conformity to the crowd, etc.) are too strong, so they disbelieve their own sound logic. The rational, contrarian, long-term value investor does just the opposite: he or she buys near the point of maximum pessimism (to use John Templeton’s phrase).

Similarly, most investors become overly optimistic when a stock is near its all-time highs. They see many other investors who have done well with the sky-high stock, and so they tend to buy at a price that is near the all-time highs. Again, many of these investors–like Isaac Newton–know analytically that buying a stock when it is near its all-time highs is often not a good idea. But greed, envy, self-deception, crowd conformity, etc. (fear of missing out, dream of a sure thing), overwhelm their own sound logic. By contrast, the rational, long-term value investor does the opposite: he or she sells near the point of maximum optimism.

Marks gives a marvelous example of psychological excess from the tech bubble of 1998-2000:

From the perspective of psychology, what was happening with IPOs is particularly fascinating. It went something like this: The guy next to you in the office tells you about an IPO he’s buying. You ask what the company does. He says he doesn’t know, but his broker told him it’s going to double on the day of issue. So you say that’s ridiculous. A week later he tells you it didn’t double… it tripled. And he still doesn’t know what it does. After a few more of these, it gets hard to resist. You know it doesn’t make sense, but you want protection against continuing to feel like an idiot. So, in a prime example of capitulation, you put in for a few hundred shares of the next IPO… and the bonfire grows still higher on the buying from new converts like you.

CONTRARIANISM

(Illustration by Sasinparaksa)

Sir John Templeton:

To buy when others are despondently selling and to sell when others are euphorically buying takes the greatest courage, but provides the greatest profit.

Superior value investors buy when others are selling, and sell when others are buying. Value investing is simple in concept, but it is very difficult in practice.

Of course, it’s not enough just to be contrarian. Your facts and your reasoning also have to be right, as Buffett points out:

You’re neither right nor wrong because the crowd disagrees with you. You’re right because your data and reasoning are right–and that’s the only thing that makes you right. And if your facts and reasoning are right, you don’t have to worry about anybody else.

Only by being right about the facts and the reasoning can a long-term value investor hold (or add to) a position when everyone else continues to sell. Getting the facts and reasoning right still involves being wrong roughly one-third of the time, whether due to bad luck, unforeseen events, or a mistake. But getting the facts and reasoning right leads to ‘being right’ roughly two-third of the time.

A robust process correctly followed should produce positive results–on both an absolute and relative basis–over most rolling five-year periods, and over nearly all rolling ten-year periods.

It’s never easy to consistently follow a careful, contrarian value investing approach. Marks quotes David Swensen:

Investment success requires sticking with positions made uncomfortable by their variance with popular opinion… Only with the confidence created by a strong decision-making process can investors sell speculative excess and buy despair-driven value.

… Establishing and maintaining an unconventional investment profile requires acceptance of uncomfortably idiosyncratic portfolios, which frequently appear downright imprudent in the eyes of conventional wisdom.

Marks puts it in his own words:

The ultimately most profitable investment actions are by definition contrarian: you’re buying when everyone else is selling (and the price is thus low) or you’re selling when everyone else is buying (and the price is high). These actions are lonely and… uncomfortable.

(Illustration by Sangoiri)

Marks writes about the paradoxical nature of investing:

The thing I find most interesting about investing is how paradoxical it is: how often the things that seem most obvious–on which everyone agrees–turn out not to be true.

The best bargains are typically only available when pessimism and uncertainty are high. Many investors say, ‘We’re not going to try to catch a falling knife; it’s too dangerous… We’re going to wait until the dust settles and the uncertainty is resolved.’ But waiting until uncertainty gets resolved usually means missing the best bargains, as Marks says:

The one thing I’m sure of is that by the time the knife has stopped falling, the dust has settled and the uncertainty has been resolved, there’ll be no great bargains left. When buying something has become comfortable again, its price will no longer be so low that it’s a great bargain. Thus, a hugely profitable investment that doesn’t begin with discomfort is usually an oxymoron.

It’s our job as contrarians to catch falling knives, hopefully with care and skill. That’s why the concept of intrinsic value is so important. If we hold a view of value that enables us to buy when everyone else is selling–and if our view turns out to be right–that’s the route to the greatest rewards earned with the least risk.

FINDING BARGAINS

It cannot be too often repeated:

A high-quality asset can constitute a good or bad buy, and a low-quality asset can constitute a good or bad buy. The tendency to mistake objective merit for investment opportunity, and the failure to distinguish between good assets and good buys, gets most investors into trouble.

What is the process by which some assets become cheap relative to intrinsic value? Marks explains:

- Unlike assets that become the subject of manias, potential bargains usually display some objective defect. An asset class may have weaknesses, a company may be a laggard in its industry, a balance sheet may be over-levered, or a security may afford its holders inadequate structural protection.

- Since the efficient-market process of setting fair prices requires the involvement of people who are analytical and objective, bargains usually are based on irrationality or incomplete understanding. Thus, bargains are often created when investors either fail to consider an asset fairly, or fail to look beneath the surface to understand it thoroughly, or fail to overcome some non-value-based tradition, bias or stricture.

- Unlike market darlings, the orphan asset is ignored or scorned. To the extent it’s mentioned at all by the media and at cocktail parties, it’s in unflattering terms.

- Usually its price has been falling, making the first-level thinker ask, ‘Who would want to own that?’ (It bears repeating that most investors extrapolate past performance, expecting the continuation of trends rather than the far-more-dependable regression to the mean. First-level thinkers tend to view price weakness as worrisome, not as a sign that the asset has gotten cheaper.)

- As a result, a bargain asset tends to be one that’s highly unpopular. Capital stays away from it or flees, and no one can think of a reason to own it.

(Illustration by Chris Dorney)

Where is the best place to look for underpriced assets? Marks observes that a good place to start is among things that are:

- little known and not fully understood;

- fundamentally questionable on the surface;

- controversial, unseemly or scary;

- deemed inappropriate for ‘respectable’ portfolios;

- unappreciated, unpopular and unloved;

- trailing a record of poor returns; and

- recently the subject of disinvestment, not accumulation.

Marks puts it briefly:

To boil it all down to just one sentence, I’d say the necessary condition for the existence of bargains is that perception has to be considerably worse than reality. That means the best opportunities are usually found among things most others won’t do. After all, if everyone feels good about something and is glad to join in, it won’t be bargain-priced.

Marks started a fund for high yield bonds–junk bonds–in 1978. One rating agency described high yield bonds as “generally lacking the characteristics of a desirable investment.” Marks remarks:

if nobody owns something, demand for it (and thus the price) can only go up and…. by going from taboo to even just tolerated, it can perform quite well.

In 1987, Marks formed a fund to invest in distressed debt:

Who would invest in companies that already had demonstrated their lack of financial viability and the weakness of their management? How could anyone invest responsibly in companies in free fall? Of course, given the way investors behave, whatever asset is considered worst at a given point in time has a good likelihood of being the cheapest. Investment bargains needn’t have anything to do with high quality. In fact, things tend to be cheaper if low quality has scared people away.

PATIENT OPPORTUNISM

Marks makes the same point that Buffett and Munger often make: Most of the time, by far the best thing to do is absolutely nothing. Finding one good idea a year is enough to get outstanding returns over time. Marks offers:

So here’s a tip: You’ll do better if you wait for investments to come to you rather than go chasing after them. You tend to get better buys if you select from the list of things sellers are motivated to sell rather than start with a fixed notion as to what you want to own. An opportunist buys things because they’re offered at bargain prices. There’s nothing special about buying when prices aren’t low.

Marks took five courses in Japanese studies as an undergraduate business major in order to fulfill his requirement for a minor. He learned the Japanese value of mujo:

… mujo means cycles will rise and fall, things will come and go, and our environment will change in ways beyond our control. Thus we must recognize, accept, cope and respond. Isn’t that the essence of investing?

… What’s past is past and can’t be undone. It has led to the circumstances we now face. All we can do is recognize our circumstances for what they are and make the best decisions we can, given the givens.

Marks quotes Buffett, who notes that there are no called strikes in investing:

Investing is the greatest business in the world because you never have to swing. You stand at the plate; the pitcher throws you General Motors at 47! U.S. steel at 39! And nobody calls a strike on you. There’s no penalty except opportunity. All day you wait for the pitch you like; then, when the fielders are asleep, you step up and hit it.

It’s dumb to invest when the opportunities are not there. But when the overall market is high, there are still a few ways to do well as a long-term value investor. If you are able to ignore short-term volatility and focus on the next five to ten years, then you can probably find some undervalued stocks, especially if you look at microcaps. At some point–the precise timing of which is unpredictable–there will be a bear market. But that would create many bargains for the long-term value investor.

KNOWING WHAT YOU DON’T KNOW

John Kenneth Galbraith:

We have two classes of forecasters: Those who don’t know–and those who don’t know they don’t know.

Marks, like Buffett, Munger, and most other top value investors, thinks that financial forecasting simply cannot be done with any sort of consistency. But Marks has two caveats:

The more we concentrate on smaller-picture things, the more it’s possible to gain a knowledge advantage. With hard work and skill, we can consistently know more than the next person about individual companies and securities, but that’s much less likely with regard to markets and economies. Thus, I suggest people try to ‘know the knowable.’

An exception comes in the form of my suggestion, on which I elaborate in the next chapter, that investors should make an effort to figure out where they stand at a moment in time in terms of cycles and pendulums. That won’t render the future twists and turns knowable, but it can help one prepare for likely developments.

Marks has tracked (in a limited way) many macro predictions, including of U.S. interest rates, the U.S. stock market, and the yen/dollar exchange rate. He found quite clearly that most forecasts were not correct.

(Illustration by Maxim Popov)

I can elaborate on two examples that I spent much time on (when I should have stayed focused on finding individual companies available at cheap prices):

- shorting the U.S. stock market

- shorting the Japanese yen

See my detailed discussion of these two “can’t lose” investments here:https://boolefund.com/the-art-value-investing/

Every year, there are many people making financial forecasts, and so purely as a matter of chance, a few forecasters will be correct in a given year. But the ones correct this year are almost never the ones correct the next time around, because what they’re trying to predict can’t be predicted with any consistency. Marks writes thus:

I am not going to try to prove my contention that the future is unknowable. You can’t prove a negative, and that certainly includes this one. However, I have yet to meet anyone who consistently knows what lies ahead macro-wise…

…

One way to get to be right sometimes is to always be bullish or always be bearish; if you hold a fixed view long enough, you may be right sooner or later. And if you’re always an outlier, you’re likely to eventually be applauded for an extremely unconventional forecast that correctly foresaw what no one else did. But that doesn’t mean your forecasts are regularly of any value…

It’s possible to be right about the macro-future once in a while, but not on a regular basis. It doesn’t do any good to possess a survey of sixty-four forecasts that includes a few that are accurate; you have to know which ones they are. And if the accurate forecasts each six months are made by different economists, it’s hard to believe there’s much value in the collective forecasts.

Marks gives one more example: How many predicted the crisis of 2007-2008? Of those who did predict it–there was bound to be some from pure chance alone–how many of those then predicted the recovery starting in 2009 and continuing until today (mid-2018)? The answer is “very few.” The reason, observes Marks, is that those who got 2007-2008 right “did so at least in part because of a tendency toward negative views.” They probably were negative well before 2007-2008, and more importantly, they probably stayed negative afterwards, during which the U.S. stock market increased (from the lows) roughly 300% as the U.S. economy expanded from 2009 to today (mid-2018).

Marks has a description for investors who believe in the value of forecasts. They belong to the “I know” school, and it’s easy to identify them:

- They think knowledge of the future direction of economies, interest rates, markets and widely followed mainstream stocks is essential for investment success.

- They’re confident it can be achieved.

- They know they can do it.

- They’re aware that lots of other people are trying to do it too, but they figure either (a) everyone can be successful at the same time, or (b) only a few can be, but they’re among them.

- They’re comfortable investing based on their opinions regarding the future.

- They’re also glad to share their views with others, even though correct forecasts should be of such great value that no one would give them away gratis.

- They rarely look back to rigorously assess their record as forecasters.

Marks contrasts the confident “I know” folks with the guarded “I don’t know” folks. The latter believe you can’t predict the macro-future, and thus the proper goal for investing is to do the best possible job analyzing individual securities. If you belong to the “I don’t know” school, eventually everyone will stop asking you where you think the market’s going. Marks:

You’ll never get to enjoy that one-in-a-thousand moment when your forecast comes true and the Wall Street Journal runs your picture. On the other hand, you’ll be spared all those times when forecasts miss the mark, as well as the losses that can result from investing based on overrated knowledge of the future.

Marks continues by noting that no one likes investing on the assumption that the future is unknowable. But if the future IS largely unknowable, then it’s far better as an investor to acknowledge that fact than to pretend otherwise.

(Photo by Elnur)

Furthermore, says Marks, the biggest problems for investors tend to happen when investors forget the difference between probability and outcome (i.e., the limits of foreknowledge):

- when they believe the shape of the probability distribution is knowable with certainty (and that they know it),

- when they assume the most likely outcome is the one that will happen,

- when they assume the expected result accurately represents the actual result, or

- perhaps most important, when they ignore the possibility of improbable outcomes.

In a word:

Overestimating what you’re capable of knowing or doing can be extremely dangerous–in brain surgery, transocean racing or investing. Acknowledging the boundaries of what you can know–and working within those limits rather than venturing beyond–can give you a great advantage.

Or as Warren Buffett has written:

Intelligent investing is not complex, though that is far from saying that it is easy. What an investor needs is the ability to correctly evaluate selected businesses. Note that word ‘selected’: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.

HAVING A SENSE FOR WHERE WE STAND

Marks believes that market cycles–inevitable ups and downs–cannot be predicted as to extent and (especially) as to timing, but have a profound influence on us as investors. The only thing we can predict is that market cycles are inevitable.

Marks holds that as investors, we can have a rough idea of market cycles. We can’t predict what will happen exactly or when. But we can at least develop valuable insight into various future events.

So look around, and ask yourself: Are investors optimistic or pessimistic? Do the media talking heads say the markets should be piled into or avoided? Are novel investment schemes readily accepted or dismissed out of hand? Are securities offerings and fund openings being treated as opportunities to get rich or possible pitfalls? Has the credit cycle rendered capital readily available or impossible to obtain? Are price/earnings ratios high or low in the context of history, and are yield spreads tight or generous? All of these things are important, and yet none of them entails forecasting. We can make excellent investment decisions on the basis of present observations, with no need to make guesses about the future.

Marks likens the process of assessing the current cycle with “taking the temperature” of the market. Again, one can never precisely time market turning points, but one can at least become aware of when markets are becoming overheated, or when they’ve become unusually cheap.

(Image by Walta, via Wikimedia Commons)

It may be more difficult today to take the market’s temperature because of the policy of low interest rates in many of the world’s major economies. This obviously distorts all asset prices. As Buffett remarked recently, if U.S. rates were going to stay very low for many decades into the future, U.S. stocks would eventually be much higher than they are today. Zero rates indefinitely would easily mean price/earnings ratios of 50 or more.

If you are able to buy enough cheap stocks, while maintaining a focus on the next five or ten years, and if you are psychologically prepared for the occasional bear market–the precise timing of which is always unpredictable–then you will be in good position.

It can also help if you find cheap stocks that have low or even negative correlation with the broad stock market:

- Gold mining stocks have often been negatively correlated with the broad market. The great economist and value investor J. M. Keynes recommended having a gold mining stock–as long as you know the company well–in your portfolio .

- Oil stocks have low correlation with the broad stock market. Many oil-related stocks are very cheap today as long as you can hold for at least five years.

- Cheap turnarounds also have low correlation with the broad stock market. If the company is turned around, the stock is likely to do well even in a bear market.

APPRECIATING THE ROLE OF LUCK

Luck–chance or randomness–influences investment outcomes. Marks considers Nassim Taleb’s Fooled by Randomness to be essential reading for investors. Writes Marks:

Randomness (or luck) plays a huge part in life’s results, and outcomes that hinge on random events should be viewed as different from those that do not.

(Albrecht Durer’sWheel of Fortunefrom Sebastien Brant’sShip of Fools(1494) via Wikimedia Commons)

Marks quotes Taleb:

If we have heard of [history’s great generals and inventors], it is simply because they took considerable risks, along with thousands of others, and happened to win. They were intelligent, courageous, noble (at times), had the highest possible obtainable culture in their day–but so did thousands of others who live in the musty footnotes of history.

A central concept from Taleb is that of “alternative histories.” What actually has happened in history is merely a small subset of all the things that could have happened, at least as far as we know. As long as there is a component of indeterminacy in human behavior (not to mention the rest of reality), you must usually assume that many “alternative histories” were possible.

As an investor, given a future that is currently unknowable in many respects, you need to develop a reasonable set of scenarios along with estimated probabilities for each scenario. And, when judging the quality of past decisions, you should think carefully about various possible histories. What actually happened is a small subset of what could have happened.

Thus, the fact that a stratagem or action worked–under the circumstances that unfolded–doesn’t necessarily prove that the decision behind it was wise.

Marks says he agrees with all of Taleb’s important points:

- Investors are right (and wrong) all the time for the ‘wrong reason.’ Someone buys a stock because he or she expects a certain development; it doesn’t occur; the market takes the stock up anyway; the investor looks good (and invariably accepts credit).

- The correctness of a decision can’t be judged from the outcome. Nevertheless, that’s how people assess it. A good decision is one that’s optimal at the time it’s made, when the future is by definition unknown. Thus, correct decisions are often unsuccessful, and vice versa.

- Randomness alone can produce just about any outcome in the short run. In portfolios that are allowed to reflect them fully, market movements can easily swamp the skillfulness of the manager (or lack thereof). But certainly market movements cannot be credited to the manager (unless he or she is the rare market timer who’s capable of getting it right repeatedly).

- For these reasons, investors often receive credit they don’t deserve. One good coup can be enough to build a reputation, but clearly a coup can arise out of randomness alone. Few of these “geniuses” are right more than once or twice in a row.

- Thus, it’s essential to have a large number of observations–lots of years of data–before judging a given manager’s ability.

Over the long run, the rational investor learns, refines, and sticks with a robust investment process that reliably produces good results. In the short run, when a good process sometimes leads to bad outcomes (often due to bad luck but sometimes due to a mistake), you must simply be stoic and patient.

Marks continues:

The actions of the ‘I know’ school are based on a view of a single future that is knowable and conquerable. My ‘I don’t know’ school thinks of future events in terms of a probability distribution. That’s a big difference. In the latter case, we may have an idea which one outcome is most likely to occur, but we also know there are many other possibilities, and those other outcomes may have a collective likelihood much higher than the one we consider most likely.

Marks concludes:

- We should spend our time trying to find value among the knowable–industries, companies and securities–rather than base our decisions on what we expect from the less-knowable macro world of economies and broad market performance.

- Given that we don’t know exactly which future will obtain, we have to get value on our side by having a strongly held, analytically derived opinion of it and buying for less when opportunities to do so present themselves.

- We have to practice defensive investing, since many of the outcomes are likely to go against us. It’s more important to ensure survival under negative outcomes than it is to guarantee maximum returns under favorable ones.

- To improve our chances of success, we have to emphasize acting contrary to the herd when it’s at extremes, being aggressive when the market is low and cautious when it’s high.

- Given the highly indeterminate nature of outcomes, we must view strategies and their results–both good and bad–with suspicion until proved over a large number of trials.

INVESTING DEFENSIVELY

Unlike professional tennis, where a successful outcome depends on which player hits the most winners, successful investing generally depends on minimizing mistakes more than it does on finding winners.

… investing is full of bad bounces and unanticipated developments, and the dimensions of the court and the height of the net change all the time. The workings of economies and markets are highly imprecise and variable, and the thinking and behavior of the other players constantly alter the environment. Even if you do everything right, other investors can ignore your favorite stock; management can squander the company’s opportunities; government can change the rules; or nature can serve up a catastrophe.

Marks argues that successful investing is a balance between offense and defense, and that this balance often differs for each individual investor. What’s important is to stick with an investment process that works over the long term:

… Few people (if any) have the ability to switch tactics to match market conditions on a timely basis. So investors should commit to an approach–hopefully one that will serve them through a variety of scenarios. They can be aggressive, hoping they’ll make a lot on the winners and not give it back on the losers. They can emphasize defense, hoping to keep up in good times and excel by losing less than others in bad times. Or they can balance offense and defense, largely giving up on tactical timing but aiming to win through superior security selection in both up and down markets.

Marks continues:

And by the way, there’s no right choice between offense and defense. Lots of possible routes can bring you to success, and your decision should be a function of your personality and leanings, the extent of your belief in your ability, and the peculiarities of the markets you work in and the clients you work for.

Marks argues that defense can be viewed as aiming for higher returns, but through the avoidance of mistakes and through consistency, rather than through home runs and occasional flashes of brilliancy.

Avoiding losses first involves buying assets at cheap prices (well below intrinsic value). Another element to avoiding losses is to ensure that your portfolio can survive a bear market. If the five-year or ten-year returns appear to be high enough, an investor still may choose to play more offense than defense, even when the broad market appears to be high. But you must be fully prepared–psychologically and in your portfolio–for stocks that are already very cheap to get cut in half or worse during a bear market.

Again, some investors can accept higher volatility in exchange for higher long-term returns. Know thyself. You must really think through all the possible scenarios, because things can get much worse than you can imagine during bear markets. And bear markets are inevitable, though unpredictable.

There is usually a trade-off between potential return and potential downside. Choosing to aim for higher long-term returns means accepting higher downside volatility over shorter periods of time.

It’s important to keep in mind that many investors fail not due to lack of home runs, but due to having too many strikeouts. Overbetting–either betting too often (investing in too many different stocks) or betting too much (having position sizes that are too large)–is thus a common cause of failure for long-term investors. We know from the Kelly criterion that overbetting guaranteesnegative long-term returns. Therefore, it’s wise for most investors to aim for consistency–a high batting average based on many singles and doubles–rather than to aim for the maximum number of home runs.

Put differently, it is easier for most investors to minimize losses than it is to hit a lot of home runs. Thus, most investors are more likely to achieve long-term success by minimizing losses and mistakes, than by hitting a lot of home runs.

As Marks concludes:

Investing defensively can cause you to miss out on things that are hot and get hotter, and it can leave you with your bat on your shoulder in trip after trip to the plate. You may hit fewer home runs than another investor… but you’re also likely to have fewer strikeouts and fewer inning-ending double plays.

Defensive investing sounds very erudite, but I can simplify it: Invest scared! Worry about the possibility of loss. Worry that there’s something you don’t know. Worry that you can make high-quality decisions but still be hit by bad luck or surprise events. Investing scared will prevent hubris; will keep your guard up and your mental adrenaline flowing; will make you insist on adequate margin of safety; and will increase the chances that your portfolio is prepared for things going wrong. And if nothing does go wrong, surely the winners will take care of themselves.

BOOLE MICROCAP FUND

An equal weighted group of micro caps generally far outperforms an equal weighted (or cap-weighted) group of larger stocks over time. See the historical chart here: https://boolefund.com/best-performers-microcap-stocks/

This outperformance increases significantly by focusing on cheap micro caps. Performance can be further boosted by isolating cheap microcap companies that show improving fundamentals. We rank microcap stocks based on these and similar criteria.

There are roughly 10-20 positions in the portfolio. The size of each position is determined by its rank. Typically the largest position is 15-20% (at cost), while the average position is 8-10% (at cost). Positions are held for 3 to 5 years unless a stock approachesintrinsic value sooner or an error has been discovered.

The mission of the Boole Fund is to outperform the S&P 500 Index by at least 5% per year (net of fees) over 5-year periods. We also aim to outpace the Russell Microcap Index by at least 2% per year (net). The Boole Fund has low fees.

If you are interested in finding out more, please e-mail me or leave a comment.

My e-mail: jb@boolefund.com

Disclosures: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. This material is distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Boole Capital, LLC.