To boost our productivity–including our ability to think and make decisions–nothing beats continuous learning. Broad study makes us better people. See:https://boolefund.com/lifelong-learning/

Michael Mauboussin is a leading expert in the multidisciplinary study of businesses and markets. His book–More Than You Know: Finding Financial Wisdom in Unconventional Places–has been translated into eight languages.

Each chapter in Mauboussin’s book is meant to stand on its own. I’ve summarized most of the chapters below.

Here’s an outline:

- Process and Outcome in Investing

- Risky Business

- Are You an Expert?

- The Hot Hand in Investing

- Time is on my Side

- The Low Down on the Top Brass

- Six Psychological Tendencies

- Emotion and Intuition in Decision Making

- Beware of Behavioral Finance

- Importance of a Decision Journal

- Right from the Gut

- Weighted Watcher

- Why Innovation is Inevitable

- Accelerating Rate of Industry Change

- How to Balance the Long Term with the Short Term

- Fitness Landscapes and Competitive Advantage

- The Folly of Using Average P/E’s

- Mean Reversion and Turnarounds

- Considering Cooperation and Competition Through Game Theory

- The Wisdom and Whim of the Collective

- Vox Populi

- Complex Adaptive Systems

- The Future of Consilience in Investing

(Photo: Statue of Leonardo da Vinci in Italy, by Raluca Tudor)

PROCESS AND OUTCOME IN INVESTING

(Image by Amir Zukanovic)

Individual decisions can be badly thought through, and yet be successful, or exceedingly well thought through, but be unsuccessful, because the recognized possibility of failure in fact occurs. But over time, more thoughtful decision-making will lead to better overall results, and more thoughtful decision-making can be encouraged by evaluating decisions on how well they were made rather than on outcome.

Robert Rubin made this remark in his Harvard Commencement Address in 2001. Mauboussin points out that the best long-term performers in any probabilistic field–such as investing, bridge, sports-team management, and pari-mutuel betting–all emphasize process over outcome.

Mauboussin also writes:

Perhaps the single greatest error in the investment business is a failure to distinguish between the knowledge of a company’s fundamentals and the expectations implied by the market price.

If you don’t understand why your view differs from the consensus, and why the consensus is likely to be wrong, then you cannot reasonably expect to beat the market. Mauboussin quotes horse-race handicapper Steven Crist:

The issue is not which horse in the race is the most likely winner, but which horse or horses are offering odds that exceed their actual chances of victory… This may sound elementary, and many players may think that they are following this principle, but few actually do. Under this mindset, everything but the odds fades from view. There is no such thing as “liking” a horse to win a race, only an attractive discrepancy between his chances and his price.

Robert Rubin’s four rules for probabilistic decision-making:

- The only certainty is that there is no certainty. It’s crucial not to be overconfident, because inevitably that leads to big mistakes. Many of the biggest hedge fund blowups resulted when people were overconfident about particular bets.

- Decisions are a matter of weighing probabilities. Moreover, you also have to consider payoffs. Probabilities alone are not enough if the payoffs are skewed. A high probability of winning does not guarantee that it’s a positive expected value bet if the potential loss is far greater than the potential gain.

- Despite uncertainty, we must act. Often in investing and in life, we have to make decisions based in imperfect or incomplete information.

- Judge decisions not only on results, but also on how they were made. If you’re making decisions under uncertainty–probabilistic decisions–you have to focus on developing the best process you can. Also, you must accept that some good decisions will have bad outcomes, while some bad decisions will have good outcomes.

Rubin again:

It’s not that results don’t matter. They do. But judging solely on results is a serious deterrent to taking risks that may be necessary to making the right decision. Simply put, the way decisions are evaluated affects the way decisions are made.

RISKY BUSINESS

(Photo by Shawn Hempel)

Mauboussin:

So how should we think about risk and uncertainty? A logical starting place is Frank Knight’s distinction: Risk has an unknown outcome, but we know what the underlying outcome distribution looks like. Uncertainty also implies an unknown outcome, but we don’t know what the underlying distribution looks like. So games of chance like roulette or blackjack are risky, while the outcome of a war is uncertain. Knight said that objective probability is the basis for risk, while subjective probability underlies uncertainty.

Mauboussin highlights three ways to get a probability, as suggested by Gerd Gigerenzer inCalculated Risks:

- Degrees of belief. Degrees of belief are subjective probabilities and are the most liberal means to translate uncertainty into a probability. The point here is that investors can translate even onetime events into probabilities provided they satisfy the laws of probability–the exhaustive and exclusive set of alternatives adds up to one. Also, investors can frequently update probabilities based on degrees of belief when new, relevant information becomes available.

- Propensities. Propensity-based probabilities reflect the properties of the object or system. For example, if a die is symmetrical and balanced, then you have a one-in-six probability of rolling any particular side… This method of probability assessment does not always consider all the factors that may shape an outcome (such as human error).

- Frequencies. Here the probability is based on a large number of observations in an appropriate reference class. Without an appropriate reference class, there can be no frequency-based probability assessment. So frequency users would not care what someone believes the outcome of a die roll will be, nor would they care about the design of the die. They would focus only on the yield of repeated die rolls.

When investing in a stock, we try to figure out the expected value by delineating possible scenarios along with a probability for each scenario. This is the essence of what top value investors like Warren Buffett strive to do.

ARE YOU AN EXPERT?

In 1996, Lars Edenbrandt, a Lund University researcher, set up a contest between an expert cardiologist and a computer. The task was to sort a large number of electrocardiograms (EKGs) into two piles–heart attack and no heart attack.

(Image by Johannes Gerhardus Swanepoel)

The human expert was Dr. Hans Ohlin, a leading Swedish cardiologist who regularly evaluated as many as 10,000 EKGs per year. Edenbrandt, an artificial intelligence expert, trained his computer by feeding it thousands of EKGs. Mauboussin describes:

Edenbrandt chose a sample of over 10,000 EKGs, exactly half of which showed confirmed heart attacks, and gave them to machine and man. Ohlin took his time evaluating the charts, spending a week carefully separating the stack into heart-attack and no-heart-attack piles. The battle was reminiscent of Garry Kasparov versus Deep Blue, and Ohlin was fully aware of the stakes.

As Edenbrandt tallied the results, a clear-cut winner emerged: the computer correctly identified the heart attacks in 66 percent of the cases, Ohlin only in 55 percent. The computer proved 20 percent more accurate than a leading cardiologist in a routine task that can mean the difference between life and death.

Mauboussin presents a table illustrating that expert performance depends on the problem type:

| Domain Description (Column) | Expert Performance | Expert Agreement | Examples |

| Rules based: Limited Degrees of Freedom | Worse than computers | High (70-90%) |

|

| Rules based: High Degrees of Freedom | Generally better than computers | Moderate (50-60%) |

|

| Probabilistic: Limited Degrees of Freedom | Equal to or worse than collectives | Moderate/ Low (30-40%) |

|

| Probabilistic: High Degrees of Freedom | Collectives outperform experts | Low (<20%) |

|

For rules-based systems with limited degrees of freedom, computers consistently outperform individual humans; humans perform well, but computers are better and often cheaper, says Mauboussin. Humans underperform computers because humans are influenced by suggestion, recent experience, and how information is framed. Also, humans fail to weigh variables well. Thus, while experts tend to agree in this domain, computers outperform experts, as illustrated by the EKG-reading example.

In the next domain–rules-based systems with high degrees of freedom–experts tend to add the most value. However, as computing power continues to increase, eventually computers will outperform experts even here, as illustrated by Chess and Go. Eventually, games like Chess and Go are “solvable.” Once the computer can check every single possible move within a reasonable amount of time–which is inevitable as long as computing power continues to increase–no human will be able to match such a computer.

In probabilistic domains with limited degrees of freedom, experts are equal to or worse than collectives. Overall, the value of experts declines compared to rules-based domains.

(Image by Marrishuanna)

In probabilistic domains with high degrees of freedom, experts do worse than collectives. For instance, stock market prices aggregate many guesses from individual investors. Stock market prices typically are more accurate than experts.

THE HOT HAND IN INVESTING

Sports fans and athletes believe in the hot hand in basketball. A player on a streak is thought to be “hot,” or more likely to make his or her shots. However, statistical analysis of streaks shows that the hot hand does not exist.

(Illustration by lbreakstock)

Long success streaks happen to the most skillful players in basketball, baseball, and other sports. To illustrate this, Mauboussin asks us to consider two basketball players, Sally Swish and Allen Airball. Sally makes 60 percent of her shot attempts, while Allen only makes 30 percent of his shot attempts.

What are the probabilities that Sally and Allen make five shots in a row? For Sally, the likelihood is (0.6)^5, or 7.8 percent. Sally will hit five in a row about every thirteen sequences. For Allen, the likelihood is (0.3)^5, or 0.24 percent. Allen will hit five straight once every 412 sequences. Sally will have far more streaks than Allen.

In sum, long streaks in sports or in money management indicate extraordinary luck imposed on great skill.

TIME IS ON MY SIDE

The longer you’re willing to hold a stock, the more attractive the investment. For the average stock, the chance that it will be higher is (almost) 100 percent for one decade, 72 percent for one year, 56 percent for one month, and 51 percent for one day.

The problem isloss aversion. We feel the pain of a loss 2 to 2.5 times more than the pleasure of an equivalent gain. If we check a stock price daily, there’s nearly a 50 percent chance of seeing a loss. So checking stock prices daily is a losing proposition. By contrast, if we only check the price once a year or once every few years, then investing in a stock is much more attractive.

A fund with a high turnover ratio is much more short-term oriented than a fund with a low turnover ratio. Unfortunately, most institutional investors have a much shorter time horizon than what is needed for the typical good strategy to pay off. If portfolio managers lag over shorter periods of time, they may lose their jobs even if their strategy works quite well over the long term.

THE LOW DOWN ON THE TOP BRASS

(Illustration by Travelling-light)

It’s difficult to judge leadership, but Mauboussin identifies four things worth considering:

- Learning

- Teaching

- Self-awareness

- Capital allocation

Mauboussin asserts:

A consistent thirst to learn marks a great leader. On one level, this is about intellectual curiosity–a constant desire to build mental models that can help in decision making. A quality manager can absorb and weigh contradictory ideas and information as well as think probabilistically…

Another critical facet of learning is a true desire to understand what’s going on in the organization and to confront the facts with brutal honesty. The only way to understand what’s going on is to get out there, visit employees and customers, and ask questions and listen to responses. In almost all organizations, there is much more information at the edge of the network–the employees in the trenches dealing with the day-to-day issues–than in the middle of the network, where the CEO sits. CEOs who surround themselves with managers seeking to please, rather than prod, are unlikely to make great decisions.

A final dimension of learning is creating an environment where everyone in the organization feels they can voice their thoughts and opinions without the risk of being rebuffed, ignored, or humiliated. The idea here is not that management should entertain all half-baked ideas but rather that management should encourage and reward intellectual risk taking.

Teaching involves communicating a clear vision to the organization. Mauboussin points out that teaching comes most naturally to those leaders who are passionate. Passion is a key driver of success.

Self-awareness implies a balance between confidence and humility. We all have strengths and weaknesses. Self-aware leaders know their weaknesses and find colleagues who are strong in those areas.

Finally, capital allocation is a vital leadership skill. Regrettably, many consultants and investment bankers give poor advice on this topic. Most acquisitions destroy value for the acquirer, regardless of whether they are guided by professional advice.

Mauboussin quotes Warren Buffett:

The heads of many companies are not skilled in capital allocation. Their inadequacy is not surprising. Most bosses rise to the top because they have excelled in an area such as marketing, production, engineering, administration or, sometimes, institutional politics.

Once they become CEOs, they face new responsibilities. They now must make capital allocation decisions, a critical job that they may have never tackled and that is not easily mastered. To stretch the point, it’s as if the final step for a highly talented musician was not to perform at Carnegie Hall but, instead, to be named Chairman of the Federal Reserve.

The lack of skill that many CEOs have at capital allocation is no small matter: After ten years on the job, a CEO whose company annually retains earnings equal to 10% of net worth will have been responsible for the deployment of more than 60% of all the capital at work in the business. CEOs who recognize their lack of capital-allocation skills (which not all do) will often try to compensate by turning to their staffs, management consultants, or investment bankers. Charlie and I have frequently observed the consequences of such “help.” On balance, we feel it is more likely to accentuate the capital-allocation problem than to solve it.

In the end, plenty of unintelligent capital allocation takes place in corporate America. (That’s why you hear so much about “restructuring.”)

SIX PSYCHOLOGICAL TENDENCIES

(Image by Andreykuzmin)

The psychologist Robert Cialdini, in his bookInfluence: The Psychology of Persuasion, mentions six psychological tendencies that cause people to comply with requests:

- Reciprocation. There is no human society where people do not feel the obligation to reciprocate favors or gifts. That’s why charitable organizations send free address labels and why real estate companies offer free house appraisals. Sam Walton was smart to forbid all of his employees from accepting gifts from suppliers, etc.

- Commitment and consistency. Once we’ve made a decision, and especially if we’ve publicly committed to that decision, we’re highly unlikely to change. Consistency allows us to stop thinking and also to avoid further action.

- Social validation. One of the chief ways we make decisions is by observing the decisions of others. In an experiment by Solomon Asch, eight people in a room are shown three lines of clearly unequal lengths. Then they are shown a fourth line that has the same length as one of the three lines. They are asked to match the fourth line to the one with equal length. The catch is that only one of the eight people in the room is the actual subject of the experiment. The other seven people are shills who have been instructed to choose an obviously incorrect answer. About 33 percent of the time, the subject of the experiment ignores the obviously right answer and goes along with the group instead.

- Liking. We all prefer to say yes to people we like–people who are similar to us, who compliment us, who cooperate with us, and who we find attractive.

- Authority. Stanley Milgram wanted to understand why many seemingly decent people–including believing Lutherans and Catholics–went along with the great evils perpetrated by the Nazis. Milgram did a famous experiment. A person in a white lab coat stands behind the subject of the experiment. The subject is asked to give increasingly severe electric shocks to a “learner” in another room whenever the learner gives an incorrect answer to a question. (Unknown to the subject, the learner in the other room is an actor and the electric shocks are not really given.) Roughly 60 percent of the time, the subject of the experiment gives a fatal shock of 450 volts to the learner. This is a terrifying result. See:https://en.wikipedia.org/wiki/Milgram_experiment

- Scarcity. Items or data that are scarce or perceived to be scarce automatically are viewed as more attractive. That’s why companies frequently offer services or products for a limited time only.

These innate psychological tendencies are especially powerful when they operate in combination. Charlie Munger calls this lollapalooza effects.

Mauboussin writes that investors are often influenced by commitment and consistency, social validation, and scarcity.

Psychologists discovered that after bettors at a racetrack put down their money, they are more confident in the prospects of their horses winning than immediately before they placed their bets. After making a decision, we feel both internal and external pressure to remain consistent to that view even if subsequent evidence questions the validity of the initial decision.

So an investor who has taken a position in a particular stock, recommended it publicly, or encouraged colleagues to participate, will feel the need to stick with the call. Related to this tendency is the confirmation trap: postdecision openness to confirming data coupled with disavowal or denial of disconfirming data. One useful technique to mitigate consistency is to think about the world in ranges of values with associated probabilities instead of as a series of single points. Acknowledging multiple scenarios provides psychological shelter to change views when appropriate.

There is a large body of work about the role of social validation in investing. Investing is an inherently social activity, and investors periodically act in concert…

Finally, scarcity has an important role in investing (and certainly plays a large role in the minds of corporate executives). Investors in particular seek informational scarcity. The challenge is to distinguish between what is truly scarce information and what is not. One means to do this is to reverse-engineer market expectations–in other words, figure out what the market already thinks.

EMOTION AND INTUITION IN DECISION MAKING

(Photo by Marek Uliasz)

Humans need to be able to experience emotions in order to make good decisions. Mauboussin writes about an experiment conducted by Antonio Damasio:

…In one experiment, he harnessed subjects to a skin-conductance-response machine and asked them to flip over cards from one of four decks; two of the decks generated gains (in play money) and the other two were losers. As the subjects turned cards, Damasio asked them what they thought was going on. After about ten turns, the subjects started showing physical reactions when they reached for a losing deck. About fifty cards into the experiment, the subjects articulated a hunch that two of the four decks were riskier. And it took another thirty cards for the subjects to explain why their hunch was right.

This experiment provided two remarkable decision-making lessons. First, the unconscious knew what was going on before the conscious did. Second, even the subjects who never articulated what was going on had unconscious physical reactions that guided their decisions.

BEWARE OF BEHAVIORAL FINANCE

Individual agents can behave irrationally but the market can still be rational.

…Collective behavior addresses the potentially irrational actions of groups. Individual behavior dwells on the fact that we all consistently fall into psychological traps, including overconfidence, anchoring and adjustment, improper framing, irrational commitment escalation, and the confirmation trap.

Here’s my main point: markets can still be rational when investors are individually irrational. Sufficient investor diversity is the essential feature in efficient price formation. Provided the decision rules of investors are diverse–even if they are suboptimal–errors tend to cancel out and markets arrive at appropriate prices. Similarly, if these decision rules lose diversity, markets become fragile and susceptible to inefficiency.

Mauboussin continues:

In case after case, the collective outperforms the individual. A full ecology of investors is generally sufficient to assure that there is no systematic way to beat the market. Diversity is the default assumption, and diversity breakdowns are the notable (and potentially profitable) exceptions.

(Illustration by Trueffelpix)

Mauboussin writes about an interesting example of how the collective can outperform individuals (including experts).

On January 17, 1966, a B-52 bomber and a refueling plane collided in midair while crossing the Spanish coastline. The bomber was carrying four nuclear bombs. Three were immediately recovered. But the fourth was lost and its recovery became a national security priority.

Assistant Security of Defense Jack Howard called a young naval officer, John Craven, to find the bomb. Craven assembled a diverse group of experts and asked them to place bets on where the bomb was. Shortly thereafter, using the probabilities that resulted from all the bets, the bomb was located. The collective intelligence in this example was superior to the intelligence of any individual expert.

IMPORTANCE OF A DECISION JOURNAL

In investing and in general, it’s wise to keep a journal of our decisions and the reasoning behind them.

(Photo by Leerobin)

We all suffer from hindsight bias. We are unable to recall what we actually thought before making a decision or judgment.

- If we decide to do something and it works out, we tend to underestimate the uncertainty that was present when we made the decision. “I knew I made the right decision.”

- If we decide to do something and it doesn’t work, we tend to overestimate the uncertainty that was present when we made the decision. “I suspected that it wouldn’t work.”

- If we judge that event X will happen, and then it does, we underestimate the uncertainty that was present when we made the judgment. “I knew that would happen.”

- If we judge that event X will happen, and it doesn’t, we overestimate the uncertainty that was present when we made the judgment. “I was fully aware that it was unlikely.”

See:https://en.wikipedia.org/wiki/Hindsight_bias

As Mauboussin notes, keeping a decision journal gives us a valuable source of objective feedback. Otherwise, we won’t recall with any accuracy the uncertainty we faced or the reasoning we used.

RIGHT FROM THE GUT

Robert Olsen has singled out five conditions that are present in the context of naturalistic decision making.

- Ill-structured and complex problems. No obvious best procedure exists to solve a problem.

- Information is incomplete, ambiguous, and changing. Because stock picking relates to future financial performance, there is no way to consider all information.

- Ill-defined, shifting, and competing goals. Although long-term goals may be clearer, goals can change over shorter horizons.

- Stress because of time constraints, high stakes, or both. Stress is clearly a feature of investing.

- Decisions may involve multiple participants.

Mauboussin describes three key characteristics of naturalistic decision makers. First, they rely heavily on mental imagery and simulation in order to assess a situation and possible alternatives. Second, they excel at pattern matching. (For instance, chess masters can glance at a board and quickly recognize a pattern.)

(Photo by lbreakstock)

Third, naturalistic decision makers reason through analogy. They can see how seemingly different situations are in fact similar.

WEIGHTED WATCHER

Mauboussin describes how we develop a “degree of belief” in a specific hypothesis:

Our degree of belief in a particular hypothesis typically integrates two kinds of evidence: the strength, or extremeness, of the evidence and the weight, or predictive validity. For instance, say you want to test the hypothesis that a coin in biased in favor of heads. The proportion of heads in the sample reflects the strength, while the sample size determines the weight.

Probability theory describes rules for how to combine strength and weight correctly. But substantial experimental data show that people do not follow the theory. Specifically, the strength of evidence seems to dominate the weight of evidence in people’s minds.

This bias leads to a distinctive pattern of over- and underconfidence. When the strength of evidence is high and the weight is low–which accurately describes the outcome of many Wall Street-sponsored surveys–people tend to be overconfident. In contrast, when the strength is low and the evidence is high, people tend to be underconfident.

(Photo by Michele Lombardo)

Does survey-based research lead to superior stock selection? Mauboussin responds that the answer is ambiguous. First, the market adjusts to new information rapidly. It’s difficult to gain an informational edge, especially when it comes to what is happening now or what will happen in the near future. In contrast, it’s possible to gain an informational edge if you focus on the longer term. That’s because many investors don’t focus there.

The second issue is that understanding the fundamentals about a company or industry is very different from understanding the expectations built into a stock price. The question is not just whether the information is new to you, but whether the information is also new to the market. In the vast majority of cases, the information is already reflected in the current stock price.

Mauboussin sums it up:

Seeking new information is a worthy goal for an investor. My fear is that much of what passes as incremental information adds little or no value, because investors don’t properly weight new information, rely on unsound samples, and fail to recognize what the market already knows. In contrast, I find that thoughtful discussions about a firm’s or an industry’s medium- to long-term competitive outlook extremely rare.

WHY INNOVATION IS INEVITABLE

(Image: Innovation concept, by Daniil Peshkov)

Mauboussin quotes Andrew Hargadon’sHow Breakthroughs Happen:

All innovations represent some break from the past–the lightbulb replaced the gas lamp, the automobile replaced the horse and cart, the steamship replaced the sailing ship. By the same token, however, all innovations are built from pieces of the past–Edison’s system drew its organizing principles from the gas industry, the early automobiles were built by cart makers, and the first steam ships added steam engines to existing sailing ships.

Mauboussin adds:

Investors need to appreciate the innovation process for a couple of reasons. First, our overall level of material well-being relies heavily on innovation. Second, innovation lies at the root of creative destruction–the process by which new technologies and businesses supersede others. More rapid innovation means more rapid success and failure for companies.

Mauboussin draws attention to three interrelated factors that continue to drive innovation at an accelerating rate:

- Scientific advances

- Information storage capacity

- Gains in computing power

ACCELERATING RATE OF INDUSTRY CHANGE

(Photo: Drosophila Melanogaster, by Tomatito26)

Mauboussin mentions the common fruit fly,Drosophila melanogaster, which geneticists and other scientists like to study because its life cycle is only two weeks.

Why should businesspeople care aboutDrosophila? A sound body of evidence now suggests that the average speed of evolution is accelerating in the business world. Just as scientists have learned a great deal about evolutionary change from fruit flies, investors can benefit from understanding the sources and implications of accelerated business evolution.

The most direct consequence of more rapid business evolution is that the time an average company can sustain a competitive advantage–that is, generate an economic return in excess of its cost of capital–is shorter than it was in the past. This trend has potentially important implications for investors in areas such as valuation, portfolio turnover, and diversification.

Mauboussin refers to research by Robert Wiggins and Timothy Ruefli on the sustainability of economic returns. They put forth four hypotheses. The first three were supported by the data, while the fourth one was not:

- Periods of persistent superior economic performance are decreasing in duration over time.

- Hypercompetition is not limited to high-technology industries but will occur through most industries.

- Over time, firms increasingly seek to sustain competitive advantage by concatenating a series of short-term competitive advantages.

- Industry concentration, large market share, or both are negatively correlated with chance of loss of persistent superior economic performance in an industry.

Mauboussin points out that faster product and process life cycles means that historical multiples are less useful for comparison. Also, the terminal valuation in discounted cash-flow models in many cases has to be adjusted to reflect shorter periods of sustainable competitive advantage.

(Image by Marek Uliasz)

Furthermore, while portfolio turnover on average is too high, portfolio turnover could be increased for those investors who have historically had a portfolio turnover of 20 percent (implying a holding period of 5 years). Similarly, shorter periods of competitive advantage imply that some portfolios should be more diversified. Lastly, faster business evolution means that investors must spend more time understanding the dynamics of organizational change.

HOW TO BALANCE THE LONG TERM WITH THE SHORT TERM

(Photo by Michael Maggs, via Wikimedia Commons)

Mauboussin notes the lessons emphasized by chess master Bruce Pandolfini:

- Don’t look too far ahead. Most people believe that great players strategize by thinking far into the future, by thinking 10 or 15 moves ahead. That’s just not true. Chess players look only as far into the future as they need to, and that usually means looking just a few moves ahead. Thinking too far ahead is a waste of time: The information is uncertain.

- Develop options and continuously revise them based on the changing conditions: Great players consider their next move without playing it. You should never play the first good move that comes into your head. Put that move on your list, and then ask yourself if there’s an even better move. If you see a good idea, look for a better one–that’s my motto. Good thinking is a matter of making comparisons.

- Know your competition: Being good at chess also requires being good at reading people. Few people think of chess as an intimate, personal game. But that’s what it is. Players learn a lot about their opponents, and exceptional chess players learn to interpret every gesture that their opponents make.

- Seek small advantages: You play for seemingly insignificant advantages–advantages that your opponent doesn’t notice or that he dismisses, thinking, “Big deal, you can have that.” It could be slightly better development, or a slightly safer king’s position. Slightly, slightly, slightly. None of those “slightlys” mean anything on their own, but add up seven or eight of them, and you have control.

Mauboussin argues that companies should adopt simple, flexible long-term decision rules. This is the “strategy as simple rules” approach, which helps us from getting caught in the short term versus long term debate.

Moreover, simple decision rules help us to be consistent. Otherwise we will often reach different conclusions from the same data based on moods, suggestion, recency bias, availability bias, framing effects, etc.

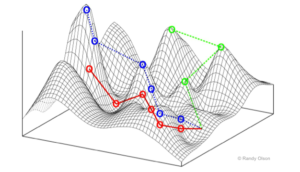

FITNESS LANDSCAPES AND COMPETITIVE ADVANTAGE

(Image: Fitness Landscape, by Randy Olsen, via Wikimedia Commons)

Mauboussin:

What does a fitness landscape look like? Envision a large grid, with each point representing a different strategy that a species (or a company) can pursue. Further imagine that the height of each point depicts fitness. Peaks represent high fitness, and valleys represent low fitness. From a company’s perspective, fitness equals value-creation potential. Each company operates in a landscape full of high-return peaks and value-destructive valleys. The topology of the landscape depends on the industry characteristics.

As Darwin noted, improving fitness is not about strength or smarts, but rather about becoming more and more suited to your environment–in a word, adaptability. Better fitness requires generating options and “choosing” the “best” ones. In nature, recombination and mutation generate species diversity, and natural selection assures that the most suitable options survive. For companies, adaptability is about formulating and executing value-creating strategies with a goal of generating the highest possible long-term returns.

Since a fitness landscape can have lots of peaks and valleys, even if a species reaches a peak (a local optimum), it may not be at the highest peak (a global optimum). To get a higher altitude, a species may have to reduce its fitness in the near term to improve its fitness in the long term. We can say the same about companies…

Mauboussin remarks that there are three types of fitness landscape:

- Stable. These are industries where the fitness landscape is reasonably stable. In many cases, the landscape is relatively flat, and companies generate excess economic returns only when cyclical forces are favorable. Examples include electric and telephone utilities, commodity producers (energy, paper, metals), capital goods, consumer nondurables, and real estate investment trusts. Companies within these sectors primarily improve their fitness at the expense of their competitors. These are businesses that tend to have structural predictability (i.e., you’ll know what they look like in the future) at the expense of limited opportunities for growth and new businesses.

- Coarse. The fitness landscape is in flux for these industries, but the changes are not so rapid as to lack predictability. The landscape here is rougher. Some companies deliver much better economic performance than do others. Financial services, retail, health care, and more established parts of technology are illustrations. These industries run a clear risk of being unseated (losing fitness) by a disruptive technology.

- Roiling. This group contains businesses that are very dynamic, with evolving business models, substantial uncertainty, and ever-changing product offerings. The peaks and valleys are constantly changing, ever spastic. Included in this type are many software companies, the genomics industry, fashion-related sectors, and most start-ups. Economic returns in this group can be (or can promise to be) significant but are generally fleeting.

Mauboussin indicates that innovation, deregulation, and globalization are probably causing the global fitness landscape to become even more contorted.

Companies can make short, incremental jumps towards a local maximum. Or they can make long, discontinuous jumps that may lead to a higher peak or a lower valley. Long jumps include investing in new potential products or making meaningful acquisitions in unrelated fields. The proper balance between short jumps and long jumps depends on a company’s fitness landscape.

Mauboussin adds that the financial tool for valuing a given business depends on the fitness landscape that the business is in. A business in a stable landscape can be valued using discounted cash-flow (DCF). A business in a course landscape can be valued using DCF plus strategic options. A business in a roiling landscape can be valued using strategic options.

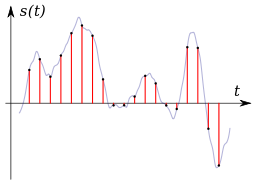

THE FOLLY OF USING AVERAGE P/E’S

Bradford Cornell:

For past averages to be meaningful, the data being averaged have to be drawn from the same population. If this is not the case–if the data come from populations that are different–the data are said to be nonstationary. When data are nonstationary, projecting past averages typically produces nonsensical results.

Nonstationarity is a key concept in time-series analysis, such as the study of past data in business and finance. If the underlying population changes, then the data are nonstationary and you can’t compare past averages to today’s population.

(Image: Time Series, by Mike Toews via Wikimedia Commons)

Mauboussin gives three reasons why past P/E data are nonstationary:

- Inflation and taxes

- Changes in the composition of the economy

- Shifts in the equity-risk premium

Higher taxes mean lower multiples, all else equal. And higher inflation also means lower multiples. Similarly, low taxes and low inflation both cause P/E ratios to be higher.

The more companies rely on intangible capital rather than tangible capital, the higher the cash-flow-to-net-income ratio. Overall, the economy is relying increasingly on intangible capital. Higher cash-flow-to-net-income ratios, and higher returns on capital, mean higher P/E ratios.

MEAN REVERSION AND TURNAROUNDS

Growth alone does not create value. Growth creates value only if the return on invested capital exceeds the cost of capital. Growth actually destroys value if the return on invested capital is less than the cost of capital.

(Illustration by Teguh Jati Prasetyo)

Over time, a company’s return on capital moves towards its cost of capital. High returns bring competition and new capital, which drives the return on capital toward the cost of capital. Similarly, capital exits low-return industries, which lifts the return on capital toward the cost of capital.

Mauboussin reminds us that a good business is not necessarily a good investment, just as a bad business is not necessarily a bad investment. What matters is the expectations embedded in the current price. If expectations are overly low for a bad business, it can represent a good investment. If expectations are too high for a good business, it may be a poor investment.

On the other hand, some cheap stocks deserve to be cheap and aren’t good investments. And some expensive-looking stocks trading at high multiples may still be good investments if high growth and high return on capital can persist long enough into the future.

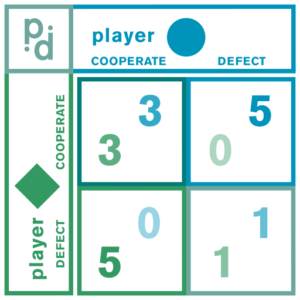

CONSIDERING COOPERATION AND COMPETITION THROUGH GAME THEORY

(Illustration: Concept of Prisoner’s Dilemma, by CXJ Jensen via Wikimedia Commons)

Mauboussin quotes Robert Axelrod’sThe Complexity of Cooperation:

What the Prisoner’s Dilemma captures so well is the tension between the advantages of selfishness in the short run versus the need to elicit cooperation from the other player to be successful over the longer run. The very simplicity of the Prisoner’s Dilemma is highly valuable in helping us to discover and appreciate the deep consequences of the fundamental processes involved in dealing with this tension.

The Prisoner’s Dilemma shows that the rational response for an individual company is not necessarily optimal for the industry as a whole.

If the Prisoner’s Dilemma game is going to be repeated many times, then the best strategy is tit-for-tat. Whatever your competitor’s latest move was, copy that for your next move. So if your competitor deviates one time and then cooperates, you deviate one time and then cooperate. Tit-for-tat is both the simplest strategy and also the most effective.

When it comes to market pricing and capacity decisions, competitive markets need not be zero sum. A tit-for-tat strategy is often optimal, and by definition it includes a policing component if your competitor deviates.

THE WISDOM AND WHIM OF THE COLLECTIVE

Mauboussin quotes Robert D. Hanson’sDecision Markets:

[Decision markets] pool the information that is known to diverse individuals into a common resource, and have many advantages over standard institutions for information aggregation, such as news media, peer review, trials, and opinion polls. Speculative markets are decentralized and relatively egalitarian, and can offer direct, concise, timely, and precise estimates in answer to questions we pose.

Mauboussin then writes about bees and ants, ending with this comment:

What makes the behavior of social insects like bees and ants so amazing is that there is no central authority, no one directing traffic. Yet the aggregation of simple individuals generates complex, adaptive, and robust results. Colonies forage efficiently, have life cycles, and change behavior as circumstances warrant. These decentralized individuals collectively solve very hard problems, and they do it in a way that is very counterintuitive to the human predilection to command-and-control solutions.

(Illustration: Swarm Intelligence, by Farbentek)

Mauboussin again:

Why do decision markets work so well? First, individuals in these markets think they have some edge, so they self-select to participate. Second, traders have an incentive to be right–they can take money from less insightful traders. Third, these markets provide continuous, real-time forecasts–a valuable form of feedback. The result is that decision markets aggregate information across traders, allowing them to solve hard problems more effectively than any individual can.

VOX POPULI

(Painting: Sir Francis Galton, by Charles Wellington Furse, via Wikimedia Commons)

Mauboussin tells of an experiment by Francis Galton:

Victorian polymath Francis Galton was one of the first to thoroughly document this group-aggregation ability. In a 1907Nature article, “Vox Populi,” Galton describes a contest to guess the weight of an ox at the West of England Fat Stock and Poultry Exhibition in Plymouth. He collected 787 participants who each paid a sixpenny fee to participate. (A small cost to deter practical joking.) According to Galton, some of the competitors were butchers and farmers, likely expert at guessing the weight. He surmised that many others, though, were guided by “such information as they might pick up” or “by their own fancies.”

Galton calculated the median estimate–the vox populi–as well as the mean. He found that the median guess was within 0.8 percent of the correct weight, and that the mean of the guesses was within 0.01 percent. To give a sense of how the answer emerged, Galton showed the full distribution of answers. Simply stated, the errors cancel out and the result is distilled information.

Subsequently, we have seen the vox populi results replicated over and over. Examples include solving a complicated maze, guessing the number of jellybeans in a jar, and finding missing bombs. In each case, the necessary conditions for information aggregation to work include an aggregation mechanism, an incentive to answer correctly, and group heterogeneity.

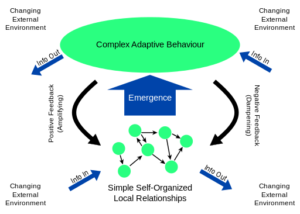

COMPLEX ADAPTIVE SYSTEMS

(Illustration by Acadac, via Wikimedia Commons)

Complex adaptive systems exhibit a number of essential properties and mechanisms, writes Mauboussin:

- Aggregation. Aggregation is the emergence of complex, large-scale behavior from the collective interactions of many less-complex agents.

- Adaptive decision rules. Agents within a complex adaptive system take information from the environment, combine it with their own interaction with the environment, and derive decision rules. In turn, various decision rules compete with one another based on their fitness, with the most effective rules surviving.

- Nonlinearity. In a linear model, the whole equals the sum of the parts. In nonlinear systems, the aggregate behavior is more complicated than would be predicted by totaling the parts.

- Feedback loops. A feedback system is one in which the output of one iteration becomes the input of the next iteration. Feedback loops can amplify or dampen an effect.

Governments, many corporations, and capital markets are all examples of complex adaptive systems.

Humans have a strong drive to invent a cause for every effect. This has been biologically advantageous for the vast majority of human history. In the past, if we heard a rustling in the grass, we immediately sought safety. There was always some cause for the noise. It virtually never made sense to wait around to see if it was a predator or not.

However, in complex adaptive systems like the stock market, typically there is no simple cause and effect relationship that explains what happens.

For many big moves in the stock market, there is no identifiable cause. But people have such a strong need identify a cause that they make up causes. The press delivers to people what they want: explanations for big moves in the stock market. Usually these explanations are simply made up. They’re false.

THE FUTURE OF CONSILIENCE IN INVESTING

(Painting: Galileo Galilei, by Justus Sustermans, via Wikimedia Commons)

Mauboussin, following Charlie Munger, argues that cross-disciplinary research is likely to produce the deepest insights into the workings of companies and markets. Here are some examples:

- Decision making and neuroscience. Prospect theory–invented by Daniel Kahneman and Amos Tversky–describes how people suffer from cognitive biases when they make decisions under uncertainty. Prospect theory is extremely well-supported by countless experiments. But prospect theory still doesn’t explain why people make the decisions they do. Neuroscience will help with this.

- Statistical properties of markets–from description to prediction? Stock price changes are not normally distributed–along a bell-shaped curve–but rather follow a power law. The statistical distribution has fat tails, which means there are more extreme moves than would occur under a normal distribution. Once again, a more accurate description is progress. But the next step involves a greater ability to explain and predict the phenomena in question.

- Agent-based models. Individual differences are important in market outcomes. Feedback mechanisms are also central.

- Network theory and information flows. Network research involves epidemiology, psychology, sociology, diffusion theory, and competitive strategy. Much progress can be made.

- Growth and size distribution. There are very few large firms and many small ones. And all large firms experience significantly slower growth once they reach a certain size.

- Flight simulator for the mind? One of the biggest challenges in investing is that long-term investors don’t get nearly enough feedback. Statistically meaningful feedback for investors typically takes decades to produce.

BOOLE MICROCAP FUND

An equal weighted group of micro caps generally far outperforms an equal weighted (or cap-weighted) group of larger stocks over time. See the historical chart here: https://boolefund.com/best-performers-microcap-stocks/

This outperformance increases significantly by focusing on cheap micro caps. Performance can be further boosted by isolating cheap microcap companies that show improving fundamentals. We rank microcap stocks based on these and similar criteria.

There are roughly 10-20 positions in the portfolio. The size of each position is determined by its rank. Typically the largest position is 15-20% (at cost), while the average position is 8-10% (at cost). Positions are held for 3 to 5 years unless a stock approachesintrinsic value sooner or an error has been discovered.

The mission of the Boole Fund is to outperform the S&P 500 Index by at least 5% per year (net of fees) over 5-year periods. We also aim to outpace the Russell Microcap Index by at least 2% per year (net). The Boole Fund has low fees.

If you are interested in finding out more, please e-mail me or leave a comment.

My e-mail: jb@boolefund.com

Disclosures: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. This material is distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Boole Capital, LLC.