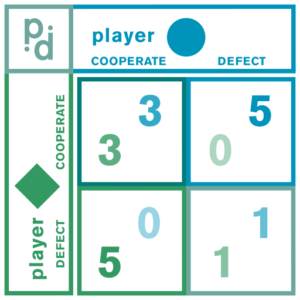

Robert G. Hagstrom has written a number of excellent books on investing. One of his best is The Detective and the Investor (Texere, 2002).

Many investors are too focused on the short term, are overwhelmed with information, take shortcuts, or fall prey to cognitive biases. Hagstrom argues that investors can learn from the Great Detectives as well as from top investigative journalists.

Great detectives very patiently gather information from a wide variety of sources. They discard facts that turn out to be irrelevant and keep looking for new facts that are relevant. They painstakingly use logic to analyze the given information and reach the correct conclusion. They’re quite willing to discard a hypothesis, no matter how well-supported, if new facts lead in a different direction.

(Illustration of Sherlock Holmes by Sidney Paget (1891), via Wikimedia Commons)

Top investigative journalists follow a similar method.

Outline for this blog post:

- The Detective and the Investor

- Auguste Dupin

- Jonathan Laing and Sunbeam

- Top Investigative Journalists

- Edna Buchanan–Pulitzer Prize Winner

- Sherlock Holmes

- Arthur Conan Doyle

- Holmes on Wall Street

- Father Brown

- How to Become a Great Detective

The first Great Detective is Auguste Dupin, an invention of Edgar Allan Poe. The financial journalist Jonathan Laing’s patient and logicalanalysis of the Sunbeam Corporation bears similarity to Dupin’s methods.

Top investigative journalists are great detectives. The Pulitzer Prize-winning journalist Edna Buchanan is an excellent example.

Sherlock Holmes is the most famous Great Detective. Holmes was invented by Dr. Arthur Conan Doyle.

Last but not least, Father Brown is the third Great Detective discussed by Hagstrom. Father Brown was invented by G. K. Chesterton.

The last section–How To Become a Great Detective–sums up what you as an investor can learn from the three Great Detectives.

THE DETECTIVE AND THE INVESTOR

Hagstrom writes that many investors, both professional and amateur, have fallen into bad habits, including the following:

- Short-term thinking: Many professional investors advertise their short-term track records, and many clients sign up on this basis. But short-term performance is largely random, and usually cannot be maintained. What matters (at a minimum) is performance over rolling five-year periods.

- Infatuation with speculation: Speculation is guessing what other investors will do in the short term. Investing, on the other hand, is figuring out the value of a given business and only buying when the price is well below that value.

- Overload of information: The internet has led to an overabundance of information. This makes it crucial that you, as an investor, know how to interpret and analyze the information.

- Mental shortcuts: We know from Daniel Kahneman (see Thinking, Fast and Slow) that most people rely on System 1 (intuition) rather than System 2 (logic and math) when making decisions under uncertainty. Most investors jump to conclusions based on easy explanations, and then–due to confirmation bias–only see evidence that supports their conclusions.

- Emotional potholes: In addition to confirmation bias, investors suffer from overconfidence, hindsight bias, loss aversion, and several other cognitive biases. These cognitive biases regularly cause investors to make mistakes in their investment decisions. I wrote about cognitive biases here:https://boolefund.com/cognitive-biases/

How can investors develop better habits? Hagstrom:

The core premise of this book is that the same mental skills that characterize a good detective also characterize a good investor… To say this another way, the analytical methods displayed by the best fictional detectives are in fact high-level decision-making tools that can be learned and applied to the investment world.

(Illustration of Sherlock Holmes by Sidney Paget, via Wikimedia Commons)

Hagstrom asks if it is possible to combine the methods of the three Great Detectives. If so, what would the ideal detective’s approach to investing be?

First, our investor-detective would have to keep an open mind, be prepared to analyze each new opportunity without any preset opinions. He or she would be well versed in the basic methods of inquiry, and so would avoid making any premature and possibly inaccurate assumptions. Of course, our investor-detective would presume that the truth might be hidden below the surface and so would distrust the obvious. The investor-detective would operate with cool calculation and not allow emotions to distract clear thinking. The investor-detective would also be able to deconstruct the complex situation into its analyzable parts. And perhaps most important, our investor-detective would have a passion for truth, and, driven by a nagging premonition that things are not what they seem to be, would keep digging away until all the evidence had been uncovered.

AUGUSTE DUPIN

(Illustration–byFrédéric Théodore Lix–to The Purloined Letter, via Wikimedia Commons)

The Murders in the Rue Morgue exemplifies Dupin’s skill as a detective. The case involves Madame L’Espanaye and her daughter. Madame L’Espanaye was found behind the house in the yard with multiple broken bones and her head almost severed. The daughter was found strangled to death and stuffed upside down into a chimney. The murders occurred in a fourth-floor room that was locked from the inside. On the floor were a bloody straight razor, several bloody tufts of grey hair, and two bags of gold coins.

Several witnesses heard voices, but no one could say for sure which language it was. After deliberation, Dupin concludes that they must not have been hearing a human voice at all. He also dismisses the possibility of robbery, since the gold coins weren’t taken. Moreover, the murderer would have to possess superhuman strength to stuff the daughter’s body up the chimney. As for getting into a locked room, the murderer could have gotten in through a window. Finally, Dupin demonstrates that the daughter could not have been strangled by a human hand. Dupin concludes that Madame L’Espanaye and her daughter were killed by an orangutan.

Dupin places an advertisement in the local newspaper asking if anyone had lost an orangutan. A sailor arrives looking for it. The sailor explains that he had seen the orangutan with a razor, imitating the sailor shaving. The orangutan had then fled. Once it got into the room with Madame L’Espanaye and her daughter, the orangutan probably grabbed Madame’s hair and was waving the razor, imitating a barber. When the woman screamed in fear, the orangutan grew furious and killed her and her daughter.

Thus Dupin solves what at first seemed like an impossible case. The solution is completely unexpected but is the only logical possibility, given all the facts.

Hagstrom writes that investors can learn important lessons from the Great Detective Auguste Dupin:

First, look in all directions, observe carefully and thoughtfully everything you see, and do not make assumptions from inadequate information. On the other hand, do not blindly accept what you find. Whatever you read, hear, or overhear about a certain stock or company may not necessarily be true. Keep on with your research; give yourself time to dig beneath the surface.

If you’re a small investor, it’s often best to invest in microcap stocks. (This presumes that you have access to a proven investment process.) There are hundreds of tiny companies much too small for most professional investors even to consider. Thus, there is much more mispricing among micro caps. Moreover, many microcap companies are relatively easy to analyze and understand. (The Boole Microcap Fund invests in microcap companies.)

JONATHAN LAING AND SUNBEAM

(Sunbeam logo, via Wikimedia Commons)

Hagstrom writes that, in the spring of 1997, Wall Street was in love with the self-proclaimed ‘turnaround genius’ Al Dunlap. Dunlap was asked to take over the troubled Sunbeam Corporation, a maker of electric home appliances. Dunlap would repeat the strategy he used on previous turnarounds:

[Drive] up the stock price by any means necessary, sell the company, and cash in his stock options at the inflated price.

Although Dunlap made massive cost cuts, some journalists were skeptical, viewing Sunbeam as being in a weak competitive position in a harsh industry. Jonathan Laing of Barron’s, in particular, took a close look at Sunbeam. Laing focused on accounting practices:

First, Laing pointed out that Sunbeam took a huge restructuring charge ($337 million) in the last quarter of 1996, resulting in a net loss for the year of $228.3 million. The charges included moving reserves from 1996 to 1997 (where they could later be recharacterized as income); prepaying advertising expenses to make the new year’s numbers look better; a suspiciously high charge for bad-debt allowance; a $90 million write-off for inventory that, if sold at a later date, could turn up in future profits; and write-offs for plants, equipment, and trademarks used by business lines that were still operating.

To Laing, it looked very much like Sunbeam was trying to find every possible way to transfer 1997 projected losses to 1996 (and write 1996 off as a lost year, claiming it was ruined by previous management) while at the same time switching 1996 income into 1997…

(Photo by Evgeny Ivanov)

Hagstrom continues:

Even though Sunbeam’s first-quarter 1997 numbers did indeed show a strong increase in sales volume, Laing had collected evidence that the company was engaging in the practice known as ‘inventory stuffing’–getting retailers to place abnormally large orders either through high-pressure sales tactics or by offering them deep discounts (using the written-off inventory from 1996). Looking closely at Sunbeam’s financial reports, Laing also found a hodgepodge of other maneuvers designed to boost sales numbers, such as delaying delivery of sales made in 1996 so they could go on the books as 1997 sales, shipping more units than the customer had actually ordered, and counting as sales orders that had already been canceled.

The bottom line was simply that much of 1997’s results would be artificial. Hagstrom summarizes the lesson from Dupin and Laing:

The core lesson for investors here can be expressed simply: Take nothing for granted, whether it comes from the prefect of police or the CEO of a major corporation. This is, in fact, a key theme of this chapter. If something doesn’t make sense to you–no matter who says it–that’s your cue to start digging.

By July 1998, Sunbeam stock had lost 80 percent of its value and was lower than when Dunlap took over. The board of directors fired Dunlap and admitted that its 1997 financial statements were unreliable and were being audited by a new accounting firm. In February 2001, Sunbeam filed for Chapter 11 bankruptcy protection. On May 15, 2001, the Securities and Exchange Commission filed suit against Dunlap and four senior Sunbeam executives, along with their accounting firm, Arthur Andersen. The SEC charged them with a fraudulent scheme to create the illusion of a successful restructuring.

Hagstrom points out what made Laing successful as an investigative journalist:

He read more background material, dissected more financial statements, talked to more people, and painstakingly pieced together what many others failed to see.

TOP INVESTIGATIVE JOURNALISTS

Hagstrom mentions Professor Linn B. Washington, Jr., a talented teacher and experienced investigative reporter. (Washington was awarded the Robert F. Kennedy Prize for his series of articles on drug wars in the Richard Allen housing project.) Hagstrom quotes Washington:

Investigative journalism is not a nine-to-five job. All good investigative journalists are first and foremost hard workers. They are diggers. They don’t stop at the first thing they come to but rather they feel a need to persist. They are often passionate about the story they are working on and this passion helps fuel the relentless pursuit of information. You can’t teach that. They either have it or they don’t.

…I think most reporters have a sense of morality. They are outraged by corruption and they believe their investigations have a real purpose, an almost sacred duty to fulfill. Good investigative reporters want to right the wrong, to fight for the underdog. And they believe there is a real responsibility attached to the First Amendment.

(Photo by Robyn Mackenzie)

Hagstrom then refers to The Reporter’s Handbook, written by Steve Weinberg for investigative journalists. Weinberg maintains that gathering information involves two categories: documents and people. Hagstrom:

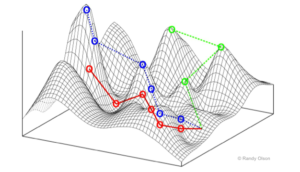

Weinberg asks readers to imagine three concentric circles. The outmost one is ‘secondary sources,’ the middle one ‘primary sources.’ Both are composed primarily of documents. The inner circle, ‘human sources,’ is made up of people–a wide range of individuals who hold some tidbit of information to add to the picture the reporter is building.

Ideally, the reporter starts with secondary sources and then primary sources:

At these two levels of the investigation, the best reporters rely on what has been called a ‘documents state of mind.‘ This way of looking at the world has been articulated by James Steele and Donald Bartlett, an investigative team from the Philadephia Inquirer. It means that the reporter starts from day one with the belief that a good record exists somewhere, just waiting to be found.

Once good background knowledge is accumulated from all the primary and secondary documents, the reporter is ready to turn to the human sources…

Time equals truth:

As they start down this research track, reporters also need to remember another vital concept from the handbook: ‘Time equals truth.‘ Doing a complete job of research takes time, whether the researcher is a reporter following a story or an investor following a company–or for that matter, a detective following the evidence at a crime scene. Journalists, investors, and detectives must always keep in mind that the degree of truth one finds is directly proportional to the amount of time one spends in the search. The road to truth permits no shortcuts.

The Reporter’s Handbook also urges reporters to question conventional wisdom, to remember that whatever they learn in their investigation may be biased, superficial, self-serving for the source, or just plain wrong. It’s another way of saying ‘Take nothing for granted.‘ It is the journalist’s responsibility–and the investor’s–to penetrate the conventional wisdom and find what is on the other side.

The three concepts discussed above–’adopt a documents state of mind,’ ‘time equals truth,’ and ‘question conventional wisdom; take nothing for granted’–may be key operating principles for journalists, but I see them also as new watchwords for investors.

EDNA BUCHANAN–PULITZER PRIZE WINNER

Edna Buchanan, working for the Miami Herald and covering the police beat, won a Pulitzer Prize in 1986. Hagstrom lists some of Buchanan’s principles:

- Do a complete background check on all the key players. Find out how a person treats employees, women, the environment, animals, and strangers who can do nothing for them. Discover if they have a history of unethical and/or illegal behavior.

- Cast a wide net. Talk to as many people as you possibly can. There is always more information. You just have to find it. Often that requires being creative.

- Take the time.Learning the truth is proportional to the time and effort you invest. There is always more that you can do. And you may uncover something crucial. Never take shortcuts.

- Use common sense. Often official promises and pronouncements simply don’t fit the evidence. Often people lie, whether due to conformity to the crowd, peer pressure, loyalty (like those trying to protect Nixon et al. during Watergate), trying to protect themselves, fear, or any number of reasons. As for investing, some stories take a long time to figure out, while other stories (especially for tiny companies) are relatively simple.

- Take no one’s word. Find out for yourself. Always be skeptical and read between the lines. Very often official press releases have been vetted by lawyers and leave out critical information. Take nothing for granted.

- Double-check your facts, and then check them again. For a good reporter, double-checking facts is like breathing. Find multiples sources of information. Again, there are no shortcuts. If you’re an investor, you usually need the full range of good information in order to make a good decision.

In most situations, to get it right requires a great deal of work. You must look for information from a broad range of sources. Typically you will find differing opinions. Not all information has the same value. Always be skeptical of conventional wisdom, or what ‘everybody knows.’

SHERLOCK HOLMES

Sherlock Holmes approaches every problem by following three steps:

- First, he makes a calm, meticulous examination of the situation, taking care to remain objective and avoid the undue influence of emotion. Nothing, not even the tiniest detail, escapes his keen eye.

- Next, he takes what he observes and puts it in context by incorporating elements from his existing store of knowledge. From his encyclopedic mind, he extracts information about the thing observed that enables him to understand its significance.

- Finally, he evaluates what he observed in the light of this context and, using sound deductive reasoning, analyzes what it means to come up with the answer.

These steps occur and re-occur in an iterative search for all the facts and for the best hypothesis.

There was a case involving a young doctor, Percy Trevelyan. Some time ago, an older gentleman named Blessington offered to set up a medical practice for Trevelyan in return for a share of the profits. Trevelyan agreed.

A patient suffering from catalepsy–a specialty of the doctor–came to the doctor’s office one day. The patient also had his son with him. During the examination, the patient suffered a cataleptic attack. The doctor ran from the room to grab the treatment medicine. But when he got back, the patient and his son were gone. The two men returned the following day, giving a reasonable explanation for the mix-up, and the exam continued. (On both visits, the son had stayed in the waiting room.)

Shortly after the second visit, Blessington burst into the exam room, demanding to know who had been in his private rooms. The doctor tried to assure him that no one had. But upon going to Blessington’s room, he saw a strange set of footprints. Only after Trevelyan promises to bring Sherlock Holmes to the case does Blessington calm down.

Holmes talks with Blessington. Blessington claims not to know who is after him, but Holmes can tell that he is lying. Holmes later tells his assistant Watson that the patient and his son were fakes and had some sinister reason for wanting to get Blessington.

Holmes is right. The next morning, Holmes and Watson are called to the house again. This time, Blessington is dead, apparently having hung himself.

But Holmes deduces that it wasn’t a suicide but a murder. For one thing, there were four cigar butts found in the fireplace, which led the policeman to conclude that Blessington had stayed up late agonizing over his decision. But Holmes recognizes that Blessington’s cigar is a Havana, but the other three cigars had been imported by the Dutch from East India. Furthermore, two had been smoked from a holder and two without. So there were at least two other people in the room with Blessington.

Holmes does his usual very methodical examination of the room and the house. He finds three sets of footprints on the stairs, clearly showing that three men had crept up the stairs. The men had forced the lock, as Holmes deduced from scratches on it.

Holmes also realized the three men had come to commit murder. There was a screwdriver left behind. And he could further deduce (by the ashes dropped) where each man sat as the three men deliberated over how to kill Blessington. Eventually, they hung Blessington. Two killers left the house and the third barred the door, implying that the third murderer must be a part of the doctor’s household.

All these signs were visible: the three sets of footprints, the scratches on the lock, the cigars that were not Blessington’s type, the screwdriver, the fact that the front door was barred when the police arrived. But it took Holmes to put them all together and deduce their meaning: murder, not suicide. As Holmes himself remarked in another context, ‘The world is full of obvious things which nobody by any chance ever observes.’

…He knows Blessington was killed by people well known to him. He also knows, from Trevelyan’s description, what the fake patient and his son look like. And he has found a photograph of Blessington in the apartment. A quick stop at policy headquarters is all Holmes needs to pinpoint their identity. The killers, no strangers to the police, were a gang of bank robbers who had gone to prison after being betrayed by their partner, who then took off with all the money–the very money he used to set Dr. Trevelyan up in practice. Recently released from prison, the gang tracked Blessington down and finally executed him.

Spelled out thus, one logical point after another, it seems a simple solution. Indeed, that is Holmes’s genius: Everything IS simple, once he explains it.

Hagstrom then adds:

Holmes operates from the presumption that all things are explainable; that the clues are always present, awaiting discovery.

The first step–gathering all the facts–usually requires a great deal of careful effort and attention. One single fact can be the key to deducing the true hypothesis. The current hypothesis is revisable if there may be relevant facts not yet known. Therefore, a heightened degree of awareness is always essential. With practice, a heightened state of alertness becomes natural for the detective (or the investor).

“Details contain the vital essence of the whole matter.”– Sherlock Holmes

Moreover, it’s essential to keep emotion out of the process of discovery:

One reason Holmes is able to see fully what others miss is that he maintains a level of detached objectivity toward the people involved. He is careful not to be unduly influenced by emotion, but to look at the facts with calm, dispassionate regard. He sees everything that is there–and nothing that is not. For Holmes knows that when emotion seeps in, one’s vision of what is true can become compromised. As he once remarked to Dr. Watson, ‘Emotional qualities are antagonistic to clear reasoning… Detection is, or ought to be, an exact science and should be treated in the same cold and unemotional manner. You have attempted to tinge it with romanticism, which produces much the same effect as if you worked a love story or an elopement into the fifth proposition of Euclid.’

Holmes himself is rather aloof and even antisocial, which helps him to maintain objectivity when collecting and analyzing data.

‘I make a point of never having any prejudices and of following docilely wherever fact may lead me.’ He starts, that is, with no preformed idea, and merely collects data. But it is part of Holmes’s brilliance that he does not settle for the easy answer. Even when he has gathered together enough facts to suggest one logical possibility, he always knows that this answer may not be the correct one. He keeps searching until he has found everything, even if subsequent facts point in another direction. He does not reject the new facts simply because they’re antithetical to what he’s already found, as so many others might.

Hagstrom observes that many investors are susceptible to confirmation bias:

…Ironically, it is the investors eager to do their homework who may be the most susceptible. At a certain point in their research, they have collected enough information that a pattern becomes clear, and they assume they have found the answer. If subsequent information then contradicts that pattern, they cannot bring themselves to abandon the theory they worked so hard to develop, so they reject the new facts.

Gathering information about an investment you are considering means gather all the information, no matter where it ultimately leads you. If you find something that does not fit your original thesis, don’t discard the new information–change the thesis.

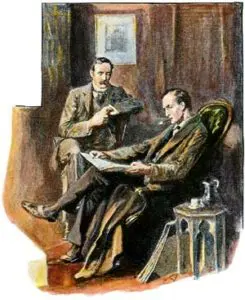

ARTHUR CONAN DOYLE

Arthur Conan Doyle was a Scottish doctor. One of his professors, Dr. Bell, challenged his students to hone their skills of observation. Bell believed that a correct diagnosis required alert attention to all aspects of the patient, not just the stated problem. Doyle later worked for Dr. Bell. Doyle’s job was to note the patients’ problem along with all possibly relevant details.

Doyle had a very slow start as a doctor. He had virtually no patients. He spent his spare time writing, which he had loved doing since boarding school. Doyle’s main interest was historical fiction. But he didn’t get much money from what he wrote.

One day he wrote a short novel, A Study in Scarlet, which introduced a private detective, Sherlock Holmes. Hagstrom quotes Doyle:

I thought I would try my hand at writing a story where the hero would treat crime as Dr. Bell treated disease, and where science would take the place of chance.

Doyle soon realized that he might be able to sell short stories about Sherlock Holmes as a way to get some extra income. Doyle preferred historical novels, but his short stories about Sherlock Holmes started selling surprisingly well. Because Doyle continued to emphasize historical novels and the practice of medicine, he demanded higher and higher fees for his short stories about Sherlock Holmes. But the stories were so popular that magazine editors kept agreeing to the fee increases.

Soon thereafter, Doyle, having hardly a single patient, decided to abandon medicine and focus on writing. Doyle still wanted to do other types of writing besides the short stories. He asked for a very large sum for the Sherlock Holmes stories so that the editors would stop bothering him. Instead, the editors immediately agreed to the huge fee.

Many years later, Doyle was quite tired of Holmes and Watson after having written fifty-six short stories and four novels about them. But readers never could get enough. And the stories are still highly popular to this day, which attests to Doyle’s genius. Doyle has always been credited with launching the tradition of the scientific sleuth.

HOLMES ON WALL STREET

Sherlock Holmes is the most famous Great Detective for good reason. He is exceptionally thorough, unemotional, and logical.

Holmes knows a great deal about many different things, which is essential in order for him to arrange and analyze all the facts:

The list of things Holmes knows about is staggering: the typefaces used by different newspapers, what the shape of a skull reveals about race, the geography of London, the configuration of railway lines in cities versus suburbs, and the types of knots used by sailors, for a few examples. He has authored numerous scientific monographs on such topics as tattoos, ciphers, tobacco ash, variations in human ears, what can be learned from typewriter keys, preserving footprints with plaster of Paris, how a man’s trade affects the shape of his hands, and what a dog’s manner can reveal about the character of its owner.

(Illustration of Sherlock Holmes with various tools, by Elena Kreys)

Consider what Holmes says about his monograph on the subject of tobacco:

“In it I enumerate 140 forms of cigar, cigarette, and pipe tobacco… It is sometimes of supreme importance as a clue. If you can say definitely, for example, that some murder has been done by a man who was smoking an Indian lunkah, it obviously narrows your field of search.”

It’s very important to keep gathering and re-gathering facts to ensure that you haven’t missed anything. Holmes:

“It is a capital mistake to theorize before you have all the evidence. It biases the judgment.”

“The temptation to form premature theories upon insufficient data is the bane of our profession.”

Although gathering all facts is essential, at the same time, you must be organizing those facts since not all facts are relevant to the case at hand. Of course, this is an iterative process. You may discard a fact as irrelevant and realize later that it is relevant.

Part of the sorting process involves a logical analysis of various combinations of facts. You reject combinations that are logically impossible. As Holmes famously said:

“When you have eliminated the impossible, whatever remains, however improbable, must be the truth.”

Often there is more than one logical possibility that is consistent with the known facts. Be careful not to be deceived by obvious hypotheses. Often what is ‘obvious’ is completely wrong.

Sometimes finding the solution requires additional research. Entertaining several possible hypotheses may also be required. Holmes:

“When you follow two separate chains of thought you will find some point of intersection which should approximate to the truth.”

But be careful to keep facts and hypotheses separate, as Holmes asserts:

“The difficulty is to detach the frame of absolute undeniable facts from the embellishments of theorists. Then, having established ourselves upon this sound basis, it is our duty to see what inferences may be drawn and what are the special points upon which the whole mystery turns.”

For example, there was a case involving the disappearance of a valuable racehorse. The chief undeniable fact was that the dog did not bark, which meant that the intruder had to be familiar to the dog.

Sherlock Holmes As Investor

How would Holmes approach investing? Hagstrom:

Here’s what we know of his methods: He begins an examination with an objective mind, untainted by prejudice. He observes acutely and catalogues all the information, down to the tiniest detail, and draws on his broad knowledge to put those details into context. Then, armed with the facts, he walks logically, rationally, thoughtfully toward a conclusion, always on the lookout for new, sometimes contrary information that might alter the outcome.

It’s worth repeating that much of the process of gathering facts can be tedious and boring. This is the price you must pay to ensure you get all the facts. Similarly, analyzing all the facts often requires patience and can take a long time. No shortcuts.

FATHER BROWN

Hagstrom opens the chapter with a scene in which Aristide Valentin–head of Paris police and the most famous investigator in Europe–is chasing Hercule Flambeau, a wealthy and famous French jewel thief. Both Valentin and Flambeau are on the same train. But Valentin gets distracted by the behavior of a very short Catholic priest with a round face. The priest is carrying several brown paper parcels, and he keeps dropping one or the other, or dropping his umbrella.

When the train reaches London, Valentin isn’t exactly sure where Flambeau went. So Valentin decides to go systematically to the ‘wrong places.’ Valentin ends up at a certain restaurant that caught his attention. A sugar bowl has salt in it, while the saltcellar contains sugar. He learns from a waiter that two clergymen had been there earlier, and that one had thrown a half-empty cup of soup against the wall. Valentin inquires which way the priests went.

Valentin goes to Carstairs Street. He passes a greengrocer’s stand where the signs for oranges and nuts have been switched. The owner is still upset about a recent incident in which a parson knocked over his bin of apples.

Valentin keeps looking and notices a restaurant that has a broken window. He questions the waiter, who explains to him that two foreign parsons had been there. Apparently, they overpaid. The waiter told the two parsons of their mistake, at which point one parson said, ‘Sorry for the confusion. But the extra amount will pay for the window I’m about to break.’ Then the parson broke the window.

Valentin finally ends up in a public park, where he sees two men, one short and one tall, both wearing clerical garb. Valentin approaches and recognizes that the short man is the same clumsy priest from the train. The short priest suspected all along that the tall man was not a priest but a criminal. The short priest, Father Brown, had left the trail of hints for the police. At that moment, even without turning around, Father Brown knew the police were nearby ready to arrest Flambeau.

Father Brown was invented by G. K. Chesterton. Father Brown is very compassionate and has deep insight into human psychology, which often helps him to solve crimes.

He knows, from hearing confessions and ministering in times of trouble, how people act when they have done something wrong. From observing a person’s behavior–facial expressions, ways of walking and talking, general demeanor–he can tell much about that person. In a word, he can see inside someone’s heart and mind, and form a clear impression about character…

His feats of detection have their roots in this knowledge of human nature, which comes from two sources: his years in the confessional, and his own self-awareness. What makes Father Brown truly exceptional is that he acknowledges the capacity for evildoing in himself. In ‘The Hammer of God’ he says, ‘I am a man and therefore have all devils in my heart.’

Because of this compassionate understanding of human weakness, from both within and without, he can see into the darkest corners of the human heart. The ability to identify with the criminal, to feel what he is feeling, is what leads him to find the identity of the criminal–even, sometimes, to predict the crime, for he knows the point at which human emotions such as fear or jealousy tip over from acceptable expression into crime. Even then, he believes in the inherent goodness of mankind, and sets the redemption of the wrongdoer as his main goal.

While Father Brown excels in understanding human psychology, he also excels at logical analysis of the facts. He is always open to alternative explanations.

(Frontispiece to G. K. Chesterton’s The Wisdom of Father Brown, Illustration by Sydney Semour Lucas, via Wikimedia Commons)

Later the great thief Flambeau is persuaded by Father Brown to give up a life of crime and become a private investigator. Meanwhile, Valentin, the famous detective, turns to crime and nearly gets away with murder. Chesterton loves such ironic twists.

Chesterton was a brilliant writer who wrote in an amazing number of different fields. Chesterton was very compassionate, with a highly developed sense of social justice, notes Hagstrom. The Father Brown stories are undoubtedly entertaining, but they also deal with questions of justice and morality. Hagstrom quotes an admirer of Chesterton, who said: ‘Sherlock Holmes fights criminals; Father Brown fights the devil.’ Whenever possible, Father Brown wants the criminal to find redemption.

Hagstrom lists what could be Father Brown’s investment guidelines:

- Look carefully at the circumstances; do whatever it takes to gather all the clues.

- Cultivate the understanding of intangibles.

- Using both tangible and intangible evidence, develop such a full knowledge of potential investments that you can honestly say you know them inside out.

- Trust your instincts. Intuition is invaluable.

- Remain open to the possibility that something else may be happening, something different from that which first appears; remember that the full truth may be hidden beneath the surface.

Hagstrom mentions that psychology can be useful for investing:

Just as Father Brown’s skill as an analytical detective was greatly improved by incorporating the study of psychology with the method of observations, so too can individuals improve their investment performance by combining the study of psychology with the physical evidence of financial statement analysis.

HOW TO BECOME A GREAT DETECTIVE

Hagstrom lists the habits of mind of the Great Detectives:

Auguste Dupin

- Develop a skeptic’s mindset; don’t automatically accept conventional wisdom.

- Conduct a thorough investigation.

Sherlock Holmes

- Begin an investigation with an objective and unemotional viewpoint.

- Pay attention to the tiniest details.

- Remain open-minded to new, even contrary, information.

- Apply a process of logical reasoning to all you learn.

Father Brown

- Become a student of psychology.

- Have faith in your intuition.

- Seek alternative explanations and re-descriptions.

Hagstrom argues that these habits of mind, if diligently and consistently applied, can help you to do better as an investor over time.

Furthermore, the true hero is reason, a lesson directly applicable to investing:

As I think back over all the mystery stories I have read, I realize there were many detectives but only one hero. That hero is reason. No matter who the detective was–Dupin, Holmes, Father Brown, Nero Wolfe, or any number of modern counterparts–it was reason that solved the crime and captured the criminal. For the Great Detectives, reason is everything. It controls their thinking, illuminates their investigation, and helps them solve the mystery.

Hagstrom continues:

Now think of yourself as an investor. Do you want greater insight about a perplexing market? Reason will clarify your investment approach.

Do you want to escape the trap of irrational, emotion-based action and instead make decisions with calm deliberation? Reason will steady your thinking.

Do you want to be in possession of all the relevant investment facts before making a purchase? Reason will help you uncover the truth.

Do you want to improve your investment results by purchasing profitable stocks? Reason will help you capture the market’s mispricing.

In sum, conduct a thorough investigation. Painstakingly gather all the facts and keep your emotions entirely out of it. Skeptically question conventional wisdom and ‘what is obvious.’ Carefully use logic to reason through possible hypotheses. Eliminate hypotheses that cannot explain all the facts. Stay open to new information and be willing to discard the best current hypothesis if new facts lead in a different direction. Finally, be a student of psychology.

BOOLE MICROCAP FUND

An equal weighted group of micro caps generally far outperforms an equal weighted (or cap-weighted) group of larger stocks over time. See the historical chart here: https://boolefund.com/best-performers-microcap-stocks/

This outperformance increases significantly by focusing on cheap micro caps. Performance can be further boosted by isolating cheap microcap companies that show improving fundamentals. We rank microcap stocks based on these and similar criteria.

There are roughly 10-20 positions in the portfolio. The size of each position is determined by its rank. Typically the largest position is 15-20% (at cost), while the average position is 8-10% (at cost). Positions are held for 3 to 5 years unless a stock approachesintrinsic value sooner or an error has been discovered.

The mission of the Boole Fund is to outperform the S&P 500 Index by at least 5% per year (net of fees) over 5-year periods. We also aim to outpace the Russell Microcap Index by at least 2% per year (net). The Boole Fund has low fees.

If you are interested in finding out more, please e-mail me or leave a comment.

My e-mail: jb@boolefund.com

Disclosures: Past performance is not a guarantee or a reliable indicator of future results. All investments contain risk and may lose value. This material is distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.No part of this article may be reproduced in any form, or referred to in any other publication, without express written permission of Boole Capital, LLC.